just for the record:

we have

Francesco Fucilla who is sometimes refered to as

Franco Fucilla who

is the father of three sons:

(source: http://www.google.de/imgres?um=1&hl=de&sa=N&biw=1366&bih=613&tbm=isch&tbnid=WkwIRt2MGLKWNM:&imgrefurl=http://www.francesco-fucilla-satires.com/FFSatires_14-10-10/Satires.html&docid=CUSqqnk8f72kbM&imgurl=http://www.francesco-fucilla-satires.com/FFSatires_14-10-10/Satires/IMAG002.JPG&w=360&h=252&ei=yruCT9yACMjTtAaM-dziBA&zoom=1&iact=hc&vpx=109&vpy=44&dur=113&hovh=188&hovw=268&tx=182&ty=120&sig=117133355990586444994&page=1&tbnh=129&tbnw=169&start=0&ndsp=19&ved=1t:429,r:0,s:0,i:66)

(source: http://www.google.de/imgres?imgurl=http://www.mindspring.com/~noetic.advanced.studies/FFucilla.JPG&imgrefurl=http://www.mindspring.com/~noetic.advanced.studies/FFucilla.html&usg=__qUTBTuSSaOZaIQTn7QEdcdGh9qk=&h=256&w=234&sz=20&hl=de&start=0&sig2=bwrGa8LqohIN9S7mrh5X7Q&zoom=1&tbnid=kupIYRvDpjVmfM:&tbnh=116&tbnw=106&ei=KsCCT4mEFIPXsgbksJHWBA&um=1&itbs=1&iact=hc&vpx=111&vpy=167&dur=829&hovh=204&hovw=187&tx=123&ty=72&sig=117133355990586444994&page=1&ndsp=1&ved=1t:429,r:0,s:0,i:46)

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

the three sons of Francesco Fucilla aka. Franco Fucilla are :

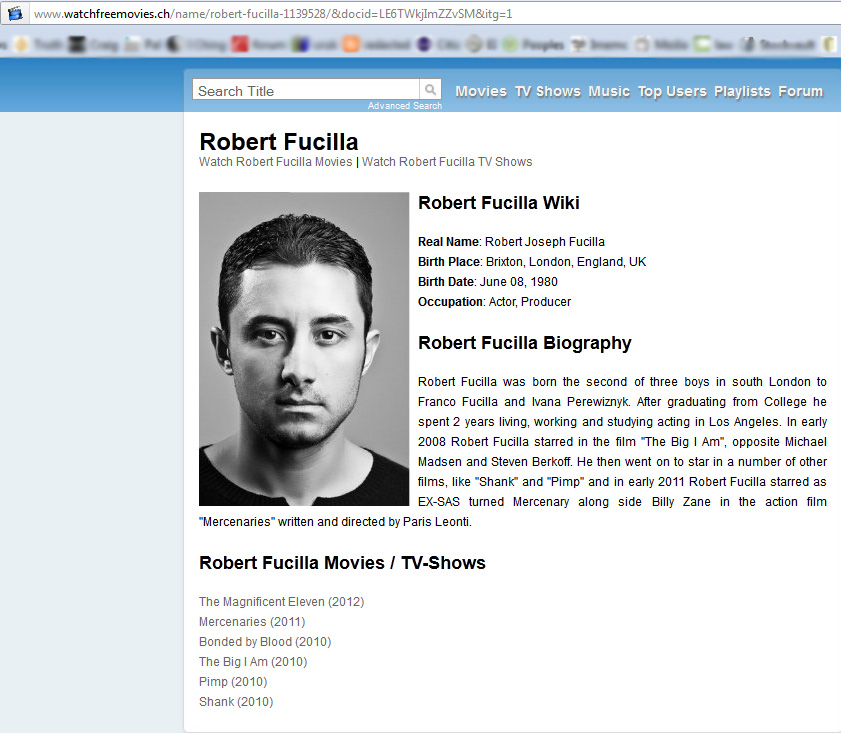

Robert Joseph Fucilla:

http://www.google.de/imgres?um=1&hl=de&sa=N&biw=1366&bih=613&tbm=isch&tbnid=Rgx1X6ivXIvGdM:&imgrefurl=http://www.watchfreemovies.ch/name/robert-fucilla-1139528/&docid=LE6TWkjImZZvSM&itg=1&imgurl=http://www.watchfreemovies.ch/content/names/robert-fucilla-1139528.jpg&w=214&h=314&ei=AByCT_fRIcnFtAb-6Kz9Bw&zoom=1&iact=hc&vpx=107&vpy=121&dur=413&hovh=251&hovw=171&tx=124&ty=164&sig=117133355990586444994&page=1&tbnh=139&tbnw=99&start=0&ndsp=25&ved=1t:429,r:0,s:0,i:66

(source: http://www.google.de/imgres?um=1&hl=de&sa=N&biw=1366&bih=613&tbm=isch&tbnid=Rgx1X6ivXIvGdM:&imgrefurl=http://www.watchfreemovies.ch/name/robert-fucilla-1139528/&docid=LE6TWkjImZZvSM&itg=1&imgurl=http://www.watchfreemovies.ch/content/names/robert-fucilla-1139528.jpg&w=214&h=314&ei=AByCT_fRIcnFtAb-6Kz9Bw&zoom=1&iact=hc&vpx=107&vpy=121&dur=413&hovh=251&hovw=171&tx=124&ty=164&sig=117133355990586444994&page=1&tbnh=139&tbnw=99&start=0&ndsp=25&ved=1t:429,r:0,s:0,i:66)

(source: http://www.zimbio.com/pictures/0VJ2eyqEa8O/Mercenaries+UK+Premiere/sblJ2SYYQMZ/Robert+Fucilla)

Robert Fucilla Wiki

Real Name: Robert Joseph Fucilla

Birth Place: Brixton, London, England, UK

Birth Date: June 08, 1980

Occupation: Actor, Producer

Robert Fucilla Biography

Robert Fucilla was born the second of three boys in south London to Franco Fucilla and Ivana Perewiznyk. After graduating from College he spent 2 years living, working and studying acting in Los Angeles. In early 2008 Robert Fucilla starred in the film "The Big I Am", opposite Michael Madsen and Steven Berkoff. He then went on to star in a number of other films, like "Shank" and "Pimp" and in early 2011 Robert Fucilla starred as EX-SAS turned Mercenary along side Billy Zane in the action film "Mercenaries" written and directed by Paris Leonti.

Robert Fucilla Movies / TV-Shows

The Magnificent Eleven (2012)

Mercenaries (2011)

Bonded by Blood (2010)

The Big I Am (2010)

Pimp (2010)

Shank (2010)

notice that the father of Robert Fucilla is called Franco Fucilla instead of Francesco Fucilla so it seems that Francesco is sometimes called Franco wich would fit with what we have seen so far.

screenshot of his BIO from www.watchfreemovies.ch :

-------------------------------------------------------------------------------------------------------------------------------------------------------------

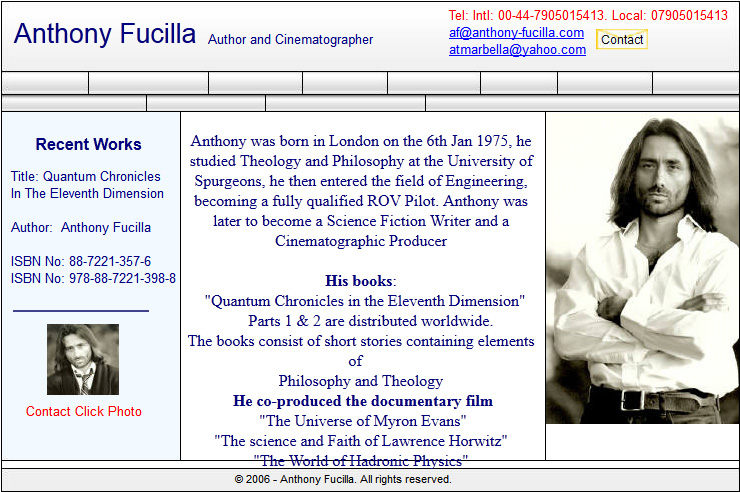

Anthony Fucilla: http://anthony-fucilla.com/

(source: http://www.google.de/imgres?hl=de&sa=X&biw=1366&bih=613&tbm=isch&prmd=imvnso&tbnid=y3d9uIF-cJJGIM:&imgrefurl=http://www.croydonguardian.co.uk/leisure/leisurenews/8311670.Purley_sci_fi_author_talks_Quantum_Chronicles/&docid=_wIhA_Ca6S7GtM&imgurl=http://www.croydonguardian.co.uk/resources/images/1380945/%253Ftype%253Ddisplay&w=300&h=450&ei=P8mCT66yOo_vsgbi6YiMBA&zoom=1&iact=hc&vpx=102&vpy=106&dur=5188&hovh=275&hovw=183&tx=134&ty=146&sig=117133355990586444994&page=1&tbnh=133&tbnw=89&start=0&ndsp=23&ved=1t:429,r:0,s:0,i:66

Anthony was born in London on the 6th Jan 1975, he studied Theology and Philosophy at the University of Spurgeons, he then entered the field of Engineering, becoming a fully qualified ROV Pilot. Anthony was later to become a Science Fiction Writer and a Cinematographic Producer

His books:

"Quantum Chronicles in the Eleventh Dimension"

Parts 1 & 2 are distributed worldwide.

The books consist of short stories containing elements of

Philosophy and Theology

He co-produced the documentary film

"The Universe of Myron Evans"

"The science and Faith of Lawrence Horwitz"

"The World of Hadronic Physics

screenshot of his bio from his website:

____________________________________________________________________________________________________________________

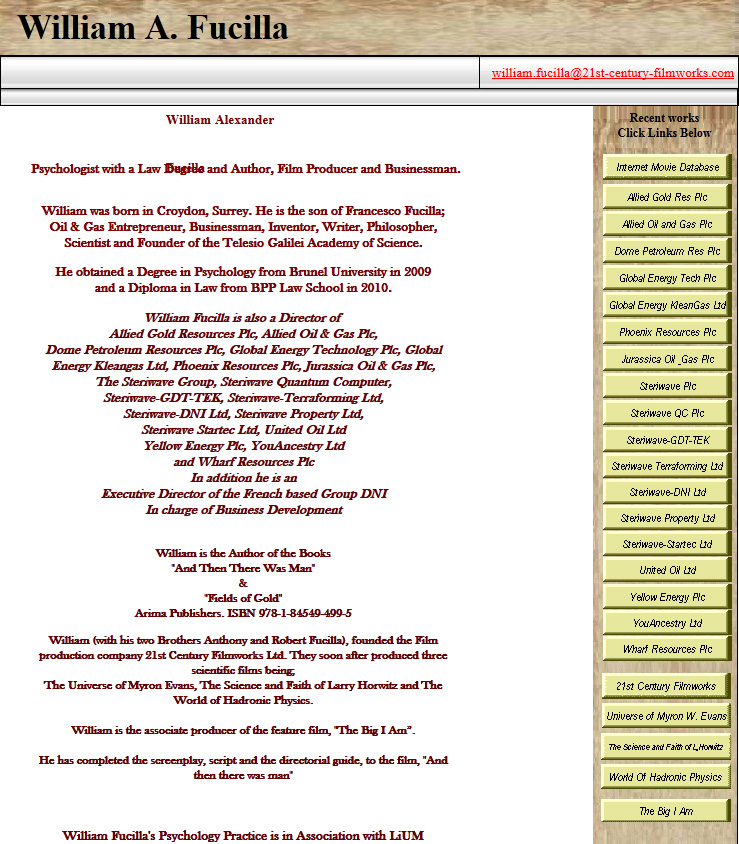

William Alexander Fucilla: http://www.william-fucilla.com/

that is the only Photo I could find, but I'm not sure if it is really William Alexander Fucilla:

(source: http://www.google.de/imgres?um=1&hl=de&sa=N&biw=1366&bih=613&tbm=isch&tbnid=EktMSWPAyET0hM:&imgrefurl=http://www.imdb.com/name/nm3042865/&docid=gafyhqM1kUFAVM&imgurl=http://ia.media-imdb.com/images/M/MV5BMTgzNDg3ODk5OV5BMl5BanBnXkFtZTcwNTkxNjQxNg%2540%2540._V1._SY314_CR11,0,214,314_.jpg&w=214&h=314&ei=QsyCT4TrCYbPtAbox5S0Bg&zoom=1&iact=hc&vpx=204&vpy=114&dur=1805&hovh=251&hovw=171&tx=118&ty=160&sig=117133355990586444994&page=1&tbnh=125&tbnw=85&start=0&ndsp=27&ved=1t:429,r:1,s:0,i:68)

from William Alexander Fucillas website :

William Alexander Fucilla

William was born in Croydon, Surrey. He is the son of Francesco Fucilla;

Oil & Gas Entrepreneur, Businessman, Inventor, Writer, Philosopher, Scientist and Founder of the Telesio Galilei Academy of Science.

He obtained a Degree in Psychology from Brunel University in 2009

and a Diploma in Law from BPP Law School in 2010.

William Fucilla is also a Director of

Allied Gold Resources Plc, Allied Oil & Gas Plc,

Dome Petroleum Resources Plc, Global Energy Technology Plc, Global Energy Kleangas Ltd, Phoenix Resources Plc, Jurassica Oil & Gas Plc,

The Steriwave Group, Steriwave Quantum Computer,

Steriwave-GDT-TEK, Steriwave-Terraforming Ltd,

Steriwave-DNI Ltd, Steriwave Property Ltd,

Steriwave Startec Ltd, United Oil Ltd

Yellow Energy Plc, YouAncestry Ltd

and Wharf Resources Plc

In addition he is an

Executive Director of the French based Group DNI

In charge of Business Development

William is the Author of the Books

"And Then There Was Man"

&

"Fields of Gold"

Arima Publishers. ISBN 978-1-84549-499-5

William (with his two Brothers Anthony and Robert Fucilla), founded the Film production company 21st Century Filmworks Ltd. They soon after produced three scientific films being;

The Universe of Myron Evans, The Science and Faith of Larry Horwitz and The World of Hadronic Physics.

William is the associate producer of the feature film, "The Big I Am”.

He has completed the screenplay, script and the directorial guide, to the film, "And then there was man"

William Fucilla's Psychology Practice is in Association with LiUM University, Psychologist Professor Orlando Del Don

notice the LiUM University, Orlando Del Don connection and also the companys he is involved in.

screenshot of his website: