Tesla Discloses US Revenues Collapsed 39%. Americans Sour on its Cars, Pent-Up Demand Exhausted

October 30, 2019 by

IWB

This is a holy-cow moment.

This morning, Tesla filed its

Form 10-Q quarterly earnings report with the SEC, a moment when no one was supposed to pay attention after the surprise quarterly profit that had caused such a hullabaloo last week. The 10-Q provides a pile of additional detail that Tesla is not required to disclose in its promo-laden earnings report that was primarily designed to downplay its first year-over-year revenue decline since the Financial Crisis.

But that revenue decline is a lot more nerve-wracking than what it looks like on the surface.

What Tesla disclosed last week:

Total revenues in the third quarter declined by 7.6% from Q3 last year, to $6.3 billion (

earnings report), the first year-over-year decline since the Financial Crisis, composed of these elements:

- Automotive revenues plunged 12% to $5.4 billion.

- Energy and storage revenues ticked up less than 1% to $402 million.

- “Services and other” revenues jumped by 68% to $548 million.

This plunge in dollar-revenues from the vehicles it sells was caused by a 37% or 10,227-unit plunge in deliveries of its high-dollar Model S and Model X, to just 17,483 units; and a 42% or 23,638-units surge of its lower-dollar but still expensive Model 3.

Total deliveries of all models combined rose 16% year-over-year to 97,186 vehicles, but now heavily skewed toward the less expensive models, with the Model S and X looking at oblivion.

What Tesla disclosed today in its 10-Q:

When an automaker’s automotive revenues plunge 12% year-over-year, that’s catastrophic enough. But the details in today’s 10-Q filing of how that plunge was composed – or rather

where it occurred – made it a lot more catastrophic: Revenues in the US, its largest market,

collapsed.

I’m not using that word lightly. When revenues plunge 39%, it’s a

collapse.

The collapse in revenues in the US was only partially offset by revenue growth in its other geographic markets. The list below shows revenues in Q3, all products and services combined, by geographic region, compared to Q3 2018:

- United States: -39% to $3.13 billion, from $5.13 billion

- China: +64% to $669 million, from $409 million

- Netherlands: +56% to $427 million, from $274 million

- Norway: +13% to $253 million, from $224 million

- “Other”: 133% to $1.83 billion, from $784 million

- Total Revenues: -8% to $6.30 billion, from $6.82 billion

For a company whose entire over-inflated stock-price story is based on hype about its endless massive growth, a

revenue decline is the end of that story. But now we’re seeing a

revenue collapse in its most important market, the US.

Why the heck this collapse in demand in the US?

There are plenty of new Tesla’s in the US. But demand has collapsed, and Tesla is now trying to offset this collapse in US demand by selling its cars elsewhere. But what has caused this collapse in US demand?

One, the Model S and X are withering away. They’re reaching the end of their life-cycle. Tesla has not redesigned them, or even just reskinned them. The Model X never took off as hoped for. Americans are now losing interest in these models. Sales are withering away. And Tesla does not appear to make any efforts at resuscitating them.

Two, pent-up demand for the Model 3 is exhausted in the US. For years before the much-delayed mass production actually started, Tesla hyped the Model 3 endlessly, with teaser-prices that were low enough to move it into the realm of a mass-market car. Tesla took deposits, and folks lined up to buy one for $35,000 or whatever. But when reality finally arrived, it was the expensive versions that were offered, and folks hoping to buy a sub-$40,000 version were strung out until this year.

By the end of last year, that pent-up demand in the US was largely exhausted. In January this year, Tesla started laying off part of its US delivery staff as deliveries were in free-fall.

Without that pent-up demand of the early fans in the US, Tesla is screwed, amid voluminous complaints about quality problems and a shortage of parts to get collision damage or warranty problems fixed that cause regular buyers to hesitate.

Three, the onslaught of EV competitors, manufactured properly by global automakers – from GM on one end to Porsche on the other – is now arriving. Tesla single-handedly made EVs cool and created the EV space; but now everyone is moving into it on a massive scale, and it’s dog-eat-dog, something Tesla has not experienced before.

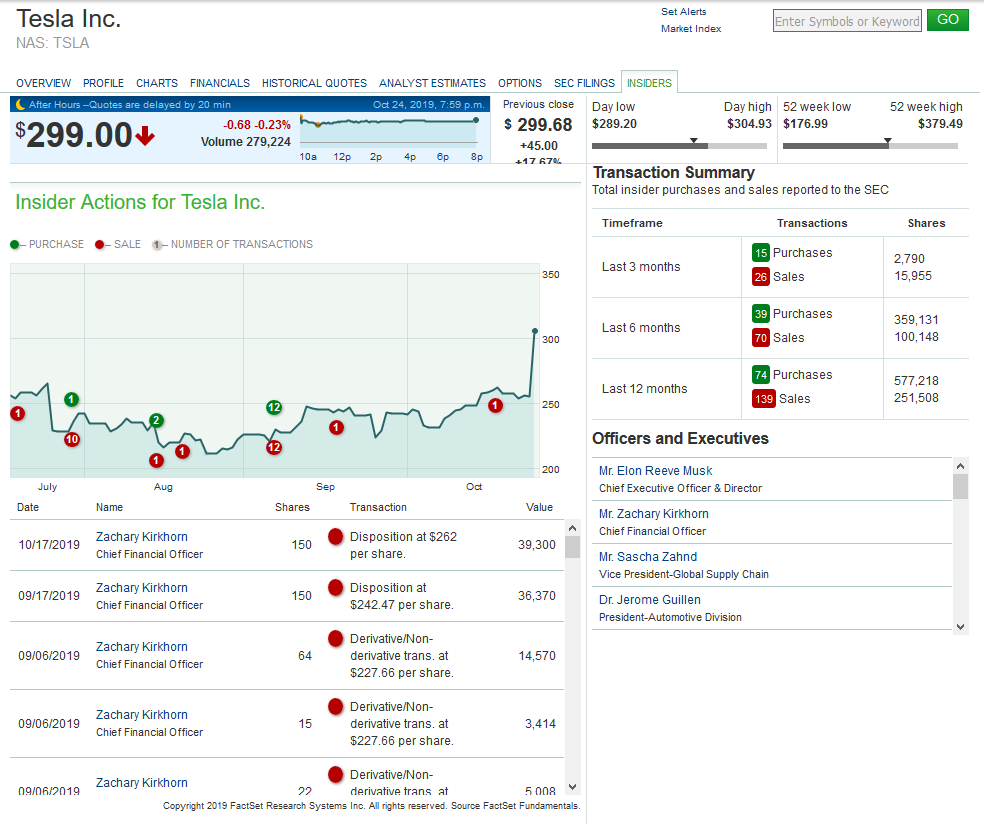

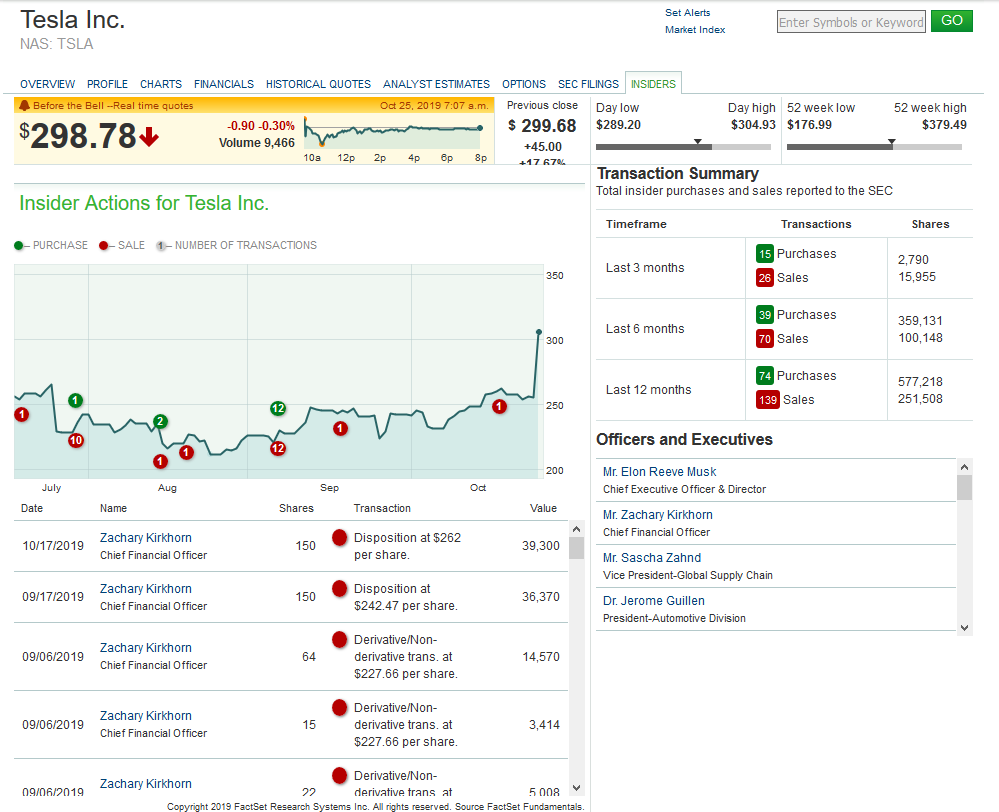

Four, federal EV incentives for Tesla’s cars are being phased out. It was long assumed that Tesla buyers, a special group of people, would buy regardless of incentives or no incentives. But that appears to have been an assumption that failed.

Now Tesla’s strategy is to exhaust any pent-up demand globally. China is the largest EV market in the world, but there are hundreds of EV makers in China, including all global automakers, that are offering a slew of EV models.

Auto sales in China have hit the skids in mid-2018. Since the phase-out of the EV incentives, even EV sales, which had been booming until recently, have started to skid, just as Tesla is launching production at its factory in Shanghai. So China is going to be tough too after Tesla’s pent-up demand, to whatever extent it might exist, has been exhausted there.

If Tesla ever becomes profitable, where should its shares be?

Given that automakers operate in a no-growth, saturated, highly competitive market, their shares trade at PE ratios in the single-digits to low double-digits. If Tesla ever makes enough money to where it has positive earnings on an annual basis, something it has never gotten even close to, it will face the same issue: What are Tesla shares worth with a PE ratio of 12, for example, if it makes a huge annual profit of $1 billion? I just did the math: $67 a share, assuming that it will ever get this gloriously profitable.

Tesla Discloses US Revenues Collapsed 39%. Americans Sour on its Cars, Pent-Up Demand Exhausted – Investment Watch

electrek.co

electrek.co