You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ever Given container ship aground in the Suez Canal

- Thread starter Mike

- Start date

Here's an explanation that seems to make sense although I'm still suspicious. From the video at 9:07 there's a good 2D animation (followed by a 3D animation) of what happened to the Ever Given. It looks like it was having issues before the crash. The navigator in the video below seems to think it was caused by bank effect and high winds. Bank effect is when the water moving past a vessel speeds up as it approaches a bank. In this case it caused the bow (front) to get sucked into the center of the canal and the stern (rear) to get sucked towards the bank. Winds from the south exacerbated the issue.

Benjamin

The Living Force

Just made a quick search to see if there has ever been another ship that has blocked the Suez Canal and there have been at least two:

www.bloomberg.com

www.bloomberg.com

I can't find anything explaining why these ships got stuck unfortunately.

How do you mean? Are you thinking something amorphously 'threatening' like China sending out a message with a warning like 'we can impose 'sanctions' too'? Or something to do with Meng Wanzhou? The video you posted seems pretty legit, though, and these tankers are getting quite unwieldy within a narrow strip of water.

Suez Canal Snarled by Giant Ship Choking Key Trade Route

A giant ship could be stuck in the Suez Canal for days, blocking one of the world’s busiest maritime trade routes that’s vital for the movement of everything from oil to consumer goods.

"The canal has been the site of occasional groundings that have halted shipping. Tugboats managed to get the OOCL Japan unstuck after a few hours in October 2017. In one of the most serious delays, the canal was closed for three days in 2004 after an oil tanker, Tropic Brilliance, got lodged."

I can't find anything explaining why these ships got stuck unfortunately.

I'm still suspicious.

How do you mean? Are you thinking something amorphously 'threatening' like China sending out a message with a warning like 'we can impose 'sanctions' too'? Or something to do with Meng Wanzhou? The video you posted seems pretty legit, though, and these tankers are getting quite unwieldy within a narrow strip of water.

How do you mean? Are you thinking something amorphously 'threatening' like China sending out a message with a warning like 'we can impose 'sanctions' too'? Or something to do with Meng Wanzhou? The video you posted seems pretty legit, though, and these tankers are getting quite unwieldy within a narrow strip of water.

I was thinking more along the lines of putting pressure on humanity during a time of already great stress. Trying to squeeze the life out of everyone. Although it does seem likely to be an accident and a symbolic message from the Universe.

I was thinking more along the lines of putting pressure on humanity during a time of already great stress. Trying to squeeze the life out of everyone. Although it does seem likely to be an accident and a symbolic message from the Universe.

The other day I was listening to Khazin (Russian economist). He mentioned the Suez canal incident and also conducted a poll among his listeners. Above 60% thought that it was deliberate. He himself said that in the end it doesn't really matter if it was intentional or an accident, because according to him, a lot of accidents like this or "accidents" often happen prior to a major change. He provided examples from history, including the collapse of the Soviet union. According to him, the West now resembles Soviet Union in the 80's, when all kind of chaotic processes were happening, some deliberate and some accidental, that basically facilitated the change. fwiw.

Guess this or other events could be a combination of deliberate actions, like the torture of Western population in form of Corona measures, or all kind of cases of negligence and major accidents that could be a representation of a general chaos/pent-up energy, or humanity sending messages to itself.

A couple of thought on the subject:

“If” it was all done on purpose, and "if" it was against globalism and not a personal vendetta, then who was last seen challenging the PTB? Putin at the WEF meeting.

Is there someone big enough to challenge the PTB, or is it the PTB breaking apart…the snake turning on itself?

Its easy to be mesmerized by the PTB and think they are invincible, but this Suez Canal thing has me thinking just how easy it would be for it all to go kaput. Whether, by some white hats, the PTB turning on itself, or the universe, if they just kicked out the Suez Canal, the panama Canal, a few precious satellites, hack a couple of soft wears programs, and Wala ! Everything would come crumbling down. And psycho would begin devouring psycho. And that’s all very do-able. Each country would have to return to producing at least, say 50% of EVERYTHING the country needs from ball point pens to milk. Back to self-reliance Then learn to trade fairly with neighbors.

FWIW I also noticed that (covid-19) = 9 and (evergreen) = 9

That gave me a little hope, thinking about how fast it could all fall apart. However, the destruction of life and property probably wouldn’t change be much. That scenario is pretty bleak too, but at least the PTB would be in the soup with us

“If” it was all done on purpose, and "if" it was against globalism and not a personal vendetta, then who was last seen challenging the PTB? Putin at the WEF meeting.

Is there someone big enough to challenge the PTB, or is it the PTB breaking apart…the snake turning on itself?

Its easy to be mesmerized by the PTB and think they are invincible, but this Suez Canal thing has me thinking just how easy it would be for it all to go kaput. Whether, by some white hats, the PTB turning on itself, or the universe, if they just kicked out the Suez Canal, the panama Canal, a few precious satellites, hack a couple of soft wears programs, and Wala ! Everything would come crumbling down. And psycho would begin devouring psycho. And that’s all very do-able. Each country would have to return to producing at least, say 50% of EVERYTHING the country needs from ball point pens to milk. Back to self-reliance Then learn to trade fairly with neighbors.

FWIW I also noticed that (covid-19) = 9 and (evergreen) = 9

That gave me a little hope, thinking about how fast it could all fall apart. However, the destruction of life and property probably wouldn’t change be much. That scenario is pretty bleak too, but at least the PTB would be in the soup with us

Recto

Jedi

A good article from the Guardian, (imagine that these days).

Stranding of Ever Given in Suez canal was foreseen by many

"Maximize economies of scale". There it is... also "megaships have been described as a 'bet on globalization'. Bottom dollar, bottom (fill in currency of almost every autocratic country in control of millions or billions of lives here).

I can't remember quite when the 'globalization is inevitable' mantra started, but I have heard it for decades - from all the 'official sources'.

When you have a complex, all encompassing economic, trade, (or other) system that roots out all alternatives, and doesn't bother with fail safes because nothing will go wrong, (wishful thinking), you are asking for trouble.

Murphy's Law states that "anything that can go wrong will go wrong". That has been true in my personal life it seems. AKA - do not tempt the lord thy god.

Another mantra that has been spread practically forever by those same official sources is: 'America should not be an isolationist country'. We don't hear that much anymore because she is now sticking her nanotech prosthetic Pinocchio nose into everybody's business these days. But I don't blame her for everything. India has a saying: "don't be shy and get pregnant". America is at least partially a victim of her own success I guess.

She's been infected with something equivalent to Toxoplasmosis gondii - the microbial parasite that is spread by cats to mice and causes mice to be less cautious around cats. Is Joe Biden's brain infected with something? Anyway, I digress.

We know that much of the evil and skullduggery on this planet comes via 4th density STS. Besides Covid-19, we have another, more esoteric pandemic going on.

Our fearless globalist leaders will manipulate any event that happens to benefit them - planned or just Murphy's Law. It's only natural right? Survival of the fittest right? The wind is at their back and their god/(their alter ego) is always on their side... right?

Meanwhile CNN already made a game out of the incident. A way to educate us on how hard it is to manoeuvre a ship that size in the Suez Canal :

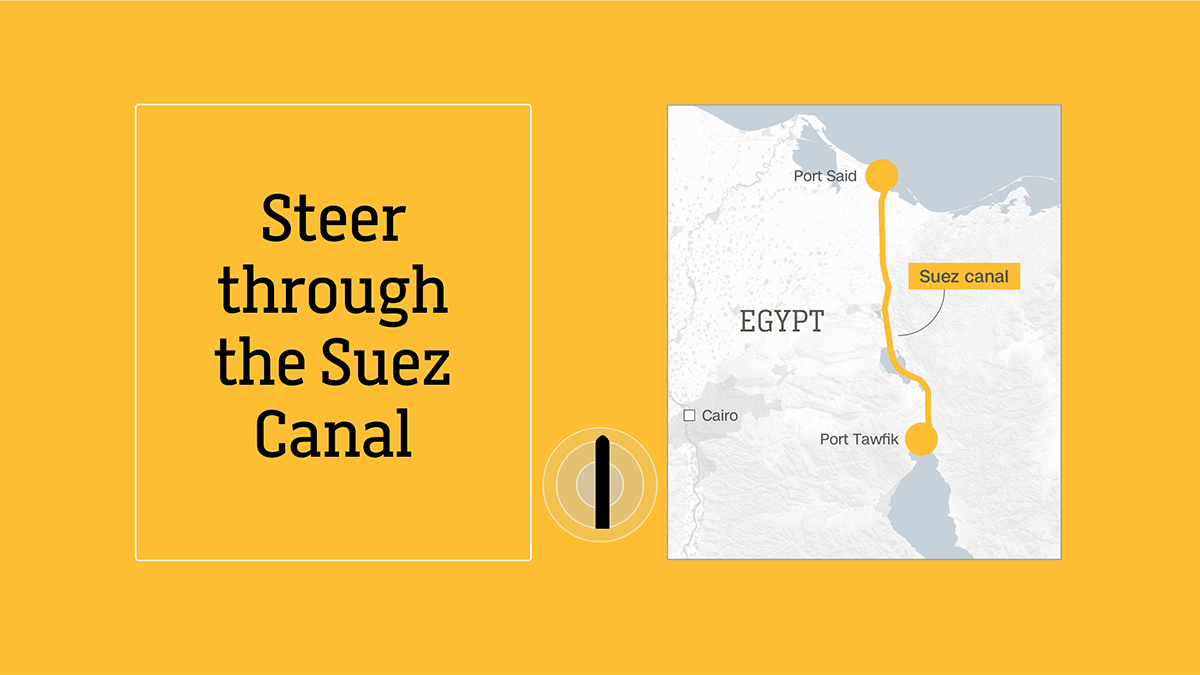

Steer through the Suez Canal

Navigating the Suez Canal is a high-stress, complicated feat that requires master piloting skills. Try your hand at it!

Steer through the Suez Canal

Navigating the Suez Canal is a high-stress, complicated feat that requires master piloting skills. To demonstrate, we worked with Master Mariner Andy Winbow and Captain Yash Gupta to produce this simulated passage.

Try your hand at traversing one of the most highly trafficked nautical thoroughfares in the world.

Note: This is a non-scientific simplified interactive experience intended for illustrative purposes only. There are many factors that have not been accounted for, including (but not restricted to): the depth of water; proximity to the banks; interaction with passing ships; the turning circle; availability of tug boats and other weather conditions like visibility. We have also sped up the time it takes to maneuver a ship of this size. Master Mariner Andy Winbow and Captain Yash Gupta have been advisers.

Here goes the 'it was bound to happen' narrative. May be true to some extent, however giving what info have been brought up in this thread I'm a bit skeptical about it being the "whole story".

The Psaki firm and Dexter connections seem like pattern recognition running amok to me.

I think we should stay focused on the three Evergreen incidents and try to work out the symbolism of these incidents.

Looking up the definition of the term evergreen, there is this interesting definition from Merriam-Webster:

So it could be that these events are physical manifestations of what is going on metaphorically around the world where the elites are burning down their own economies and blocking the flow of creative energies and causing a backup which has serious negative consequences.

We could also take it literally, as in something that is green/lush/full of life (as a forest) at any time/forever. Remind me of the Garden of Eden. And seeing it being subsequently burnt to the ground, crashed, sunk, subverted, etc, can very well be a warning of impending turmoil and danger indeed.

Here goes the 'it was bound to happen' narrative. May be true to some extent, however giving what info have been brought up in this thread I'm a bit skeptical about it being the "whole story".

After going through the thread, I've not seen anything of substance brought up here that suggests anything more.

What I'm looking for is some evidence of a person or company shorting a large number of stocks for Evergreen hours before the event, a cargo ship containing the latest anti-aircraft missiles destined for Syria sent from Russia that are needed for an upcoming engagement, or something along those lines. At this point I'm also looking for ramifications that would suggest a motive such as Iran running out of food, thousands of people in Europe dying from a lack of medicine, or something along those lines.

Some terrible people with either a similar code name or a company with the same name is, to me, merely coincidence.

Considering it's been a week and nothing really substantial seems to have come out of this event, I'm inclined to think it was just an accident. Though a symbolic one.

Last edited:

Here's part of what the WEF had to say about it on the 25th of March.

Work to expand the Suez was completed mid 2015 and the WEF statement about it:

As researchers of maritime security, we often simulate incidents like the Ever Given grounding to understand the probable long and short-term consequences. In fact, the recent event is near identical to something we have been discussing for the last month, as it represents an almost worst-case scenario for the Suez Canal and for knock-on effects on global trade.

Work to expand the Suez was completed mid 2015 and the WEF statement about it:

The first ships have passed through Egypt’s Suez Canal expansion in a trial run ahead of next month’s official opening. If completed on time, the $8.5 billion project will have been finished in only 12 months.

Egypt ranked 119th out of 144 economies in last year’s Global Competitiveness Report, and 97th out of 138 in its Global Enabling Trade Report. The canal expansion is intended to improve these performances. It’s also intended to address youth unemployment, a particular concern in a country where 60% of the population is under 40 years old. Egypt’s President Abdelfattah Said Hussein Alsisi told delegates at the World Economic Forum’s Annual Meeting that once the expansion is open, “the second phase will entail developing the canal zone and opening the door for investment”.

If the Suez Canal blockage has been planned it could just be to put more pressure on middle class businesses. Here's an excerpt from Companion to Marx's Capital Volume 2 by David Harvey. Curiously enough, it actually mentions a blockage in the Suez Canal!

So basically, extended delivery times slow down cash circulation for producers, wholesalers and retailers. If they've got cash reserves, they can dip into that to keep themselves afloat. If they haven't, which is likely given the impact on businesses of the response to coronavirus, then they have to apply for credit in an environment where interest rates are likely to rise because of vulture capitalism. Basically another transfer of wealth.

Marx works through three different detailed examples in which the circulation time is shorter, equal to, and longer than the working period. He does so in excruciating detail and, of course, discovers some oddities (provided the credit system does not intervene). In particular, he shows that there are instances – as when the circulation time and working period are equal or when one is a simple multiple of the other – when no capital is freed up at all. But these are clearly special cases. In all other instances, the amount of capital freed up varies according to the turnover time and the ratio between working period and circulation time. The amount of free money capital created will also fluctuate according to the overlapping turnover processes that ensure the continuity of production.

But the main point is prefigured and somewhat obvious already (even though conventional economists had failed to spot it): “If we consider the total social capital, then a more or less significant part of this additional capital exists for a prolonged time in the state of money capital.” For the individual capital, the

intervention of the additional capital required for the conversion of….circulation time into production time thus not only increases the size of the capital advanced and the length of time for which the total capital has to be advanced, but it also specifically increases that part of the capital advanced that exists as a money reserve, i.e. exists in the state of money capital and possesses the form of potential money capital. (341)

As usual, Marx uses this insight to go after the economists

who have never produced a clear account of the turnover mechanism, [and who] constantly overlook this basic aspect, i.e. the fact that only a part of the industrial capital can be actually engaged in the production process, if production is to proceed without interruption. In other words, one part can function as productive capital only on condition that another part is withdrawn from production proper in the form of commodity or money capital. Since this is overlooked, so also is the importance and role of money capital in general (342)

By extension, this must surely apply also to money markets and credit although this is an issue that is not directly taken up here.

Plainly, if there is some reduction in circulation time (due, for example, to improvements in transportation and marketing) in relation to production time, then this too will release excess money capital for use elsewhere. Under such conditions, some of the

value originally advanced is precipitated out in the form of money capital. As such it enters the money market and forms and additional part of the capital functioning there. We can see from this how a surfeit of money capital can arise – and not only in the sense that the supply of money capital is greater than the demand for it; the latter is never more than a relative surplus, which is found for instance in the depressed period that opens the new business cycle after the crisis is over. It is rather in the sense that a definite part of the capital advanced is superfluous for the overall process of a social reproduction (which includes the circulation process) and is therefore precipitated out in the form of money capital; it is thus a surplus which has arisen…..simply by a contraction in the turnover period. (358)

We can thus imagine a scenario in which the reductions in the time of transport outlined in the previous chapter may dramatically reduce circulation times, and so release a flood of surplus money capital onto the money markets, which will bring interest rates down. Conversely, if the circulation time is for some reason extended (for example, the Suez Canal gets blocked), then “additional capital will have to be obtained… from the money market”; by which Marx presumably means that the extra demand for money capital will, other things being equal, drive up interest rates (358-9).

So basically, extended delivery times slow down cash circulation for producers, wholesalers and retailers. If they've got cash reserves, they can dip into that to keep themselves afloat. If they haven't, which is likely given the impact on businesses of the response to coronavirus, then they have to apply for credit in an environment where interest rates are likely to rise because of vulture capitalism. Basically another transfer of wealth.

@Jones, when you get down to the end of the article they say:

In other words, nothing is happening as a result of the incident. No calls for greater top down control of economies. No rallies for globalized leadership. No one is really put out in any significant or lasting way. Nothing like what happened after the Beirut explosion or the Las Vegas shooting.

So all signs still point to accident.

As an aside, after reading the article I feel a little disappointed and even a little cheated because not once did I come across the WEF's stock "and this is why we need a Great Reset" response. I kept waiting for it to come up and it never did. Maybe I should ask Schwab to reset the article?

That's making a number of assumptions that aren't necessarily true. For example, interest rates are not on the rise. As another example, I've seen a number of articles talking about a possible toilet paper shortage, coffee shortage, and a number of other issues but not one mention of a large number of businesses potentially going under as a result. That doesn't mean some won't. However, we're not seeing anything at all let alone enough suggestive that the incident was intentional like we did with the deluge of articles that came out after the start of lockdowns talking about how business were going to go under as a result.

Edit: Cut out last section of poor arguments.

While not identical to our team’s table-top scenario, the latest incident does highlight that as ships get larger and more complicated, their reliance on narrow shipping routes constructed in an earlier age looks increasingly risky. Today’s blockage will have limited long-term implications, but incidents like it could be triggered maliciously, causing targeted or widespread impacts on global and local trade. We need to be more aware of these weaknesses as our world becomes more connected.

In other words, nothing is happening as a result of the incident. No calls for greater top down control of economies. No rallies for globalized leadership. No one is really put out in any significant or lasting way. Nothing like what happened after the Beirut explosion or the Las Vegas shooting.

So all signs still point to accident.

As an aside, after reading the article I feel a little disappointed and even a little cheated because not once did I come across the WEF's stock "and this is why we need a Great Reset" response. I kept waiting for it to come up and it never did. Maybe I should ask Schwab to reset the article?

If the Suez Canal blockage has been planned it could just be to put more pressure on middle class businesses. Here's an excerpt from Companion to Marx's Capital Volume 2 by David Harvey. Curiously enough, it actually mentions a blockage in the Suez Canal!

So basically, extended delivery times slow down cash circulation for producers, wholesalers and retailers. If they've got cash reserves, they can dip into that to keep themselves afloat. If they haven't, which is likely given the impact on businesses of the response to coronavirus, then they have to apply for credit in an environment where interest rates are likely to rise because of vulture capitalism. Basically another transfer of wealth.

That's making a number of assumptions that aren't necessarily true. For example, interest rates are not on the rise. As another example, I've seen a number of articles talking about a possible toilet paper shortage, coffee shortage, and a number of other issues but not one mention of a large number of businesses potentially going under as a result. That doesn't mean some won't. However, we're not seeing anything at all let alone enough suggestive that the incident was intentional like we did with the deluge of articles that came out after the start of lockdowns talking about how business were going to go under as a result.

Edit: Cut out last section of poor arguments.

Last edited:

For example, interest rates are not on the rise.

Well that's from mid last year when the market was still being some what propped up by stimulus packages. Also interest rates have been abnormally low since the 2008 GFC - that was also a move to prop the market up that will come to an end sooner or later.

There are more articles like these showing up in the news recently:

February 23, 2021:

Interest rates are rising and tech stocks are likely to head in the other direction

ASX investors watch out for a rise in interest rates in 2022

March 19, 2021:

Mortgage Interest Rates Forecast: Will Rates Rise In 2021?

March 21, 2021:Prepare Yourself For Much Higher Long Term Interest Rates

April 1, 2021:Mortgage rates have skyrocketed in recent months — adding $33,000 on average to a 30-year loan

Also where there is a trade contract and the supplier gives 30, 60 or 90 day payment terms for example, extended delivery times can push payments out and if those payments are later than the agreed payment terms, the contract often includes the addition of interest or additional fees on late payments. So credit isn't necessarily just extended by banks, but it can still push up operational costs and increase the squeeze on businesses.

So if the Suez blockage was planned, debt entrapment is one of the oldest plays in the book for the transfer of property and wealth, so there's the financial motivation for it.

You ask some good questions though and I don't have the answers for them yet.

Well that's from mid last year when the market was still being some what propped up by stimulus packages.

You're right, it was old. Thank you for pointing that out and giving more current sources.

Also interest rates have been abnormally low since the 2008 GFC - that was also a move to prop the market up that will come to an end sooner or later.

Abnormally low interest rates are the norm for a time when the market "needs help", so to say. Therefore a rise to previous levels is a sign that "help" is no longer needed and that there is a return to more normal economic strength. It's not a sign of vulture capitalism.

If, however, there was a vulture capitalist nature to the rate hikes, then I would expect to see rates go above pre-Covid levels with a number of economists or economic experts saying that the rates are above what the market can handle with warnings that small businesses will not be able to cope, if indeed the target was small businesses, with accusations being leveled against creditors that this is vulture capitalism or something to that affect. Basically, I'd expect something like what happened with the lockdowns where a number of people in the alternative media sphere saying how those policies were going to kill small businesses and seemed to have been designed to do just that.

I'm not seeing any of those things. There's always the possibility that I'm missing something or not looking in the right places. I looked through some articles from ZeroHedge and tried to find articles from similar outlets who've had no problem in the past calling out predatory practices and none of them are saying anything along the lines that we're talking about here in terms of rate hikes and vulture capitalism. I also didn't see anything relating the incident to an expected upcoming increase in small business closures either now or in the future.

So I'm still waiting to see anything real that would suggest there actually was a financial incentive.

Also where there is a trade contract and the supplier gives 30, 60 or 90 day payment terms for example, extended delivery times can push payments out and if those payments are later than the agreed payment terms, the contract often includes the addition of interest or additional fees on late payments. So credit isn't necessarily just extended by banks, but it can still push up operational costs and increase the squeeze on businesses.

Assuming this is correct, where are the actual incidents of this and where has it lead to small business closures? I understand that it would take longer than a week for what you're talking about to manifest, but assuming you're right and there is enough supportive evidence for it at the moment then I'd expect others with more knowledge of markets to be saying similar things. Are there any market analysts saying that this is happening?

So if the Suez blockage was planned, debt entrapment is one of the oldest plays in the book for the transfer of property and wealth, so there's the financial motivation for it.

If it was planned then there likely would be a financial motivation for it, sure. However, I've yet to find anything of substance that supports the hypothesis that it was a planned event intended to further disrupt markets and drive more small businesses under in a wealth redistribution scheme.

If it was for wealth redistribution then where's the wealth redistribution?

What I'm also wondering is why does this have to be a planned thing? Why can't it be just an accident that exacerbates current problems?

You ask some good questions though and I don't have the answers for them yet.

For sake of letting people know what I asked, assuming @Jones that you're referring to the questions that I cut out, here's more or less what I had written at the time:

In the WEF article they said that the incident could've been worse both in terms of where the grounding of the ship took place and in terms of the time of year. Now if these guys or someone like them did a table-top scenario with the idea of doing as Jones posited, then why crash the ship in the not worst place and why at the not worst time as they previously identified as being the worst case scenario for everyone else and a best case scenario for them and their plan?

Also, if the lockdowns have already been super effective at doing the same thing, why block the Suez when governments can just create a new variant and impose more lockdowns?

G Webb thinks the blocking helps the newly made pipeline from UAE to Israel.

Evergreen was a name for CIA fronts.

Evergreen was a name for CIA fronts.

Aquarian1962

Padawan Learner

Has anyone seen reports about the containers being opened and what was found? I have seen it on a couple alt news posts, but certainly nothing confirmed...

Trending content

-

-

Thread 'Coronavirus Pandemic: Apocalypse Now! Or exaggerated scare story?'

- wanderingthomas

Replies: 30K -

-