The meltdown's continue.

November 21, 2018, 6:03 PM GMT+1

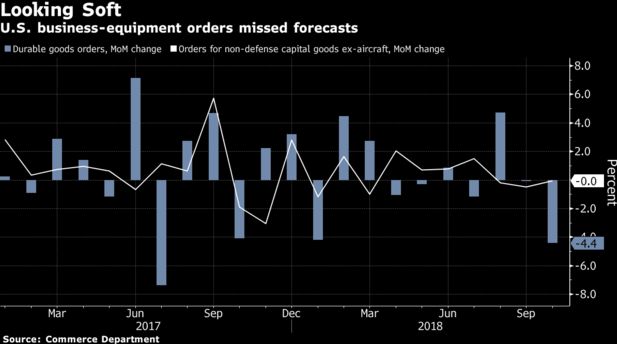

Weaker-than-projected reports Wednesday on business investment, consumer confidence and the job market signaled the U.S. economy is shifting into a lower gear, leaving less cheer as Americans head into the Thanksgiving holiday weekend.

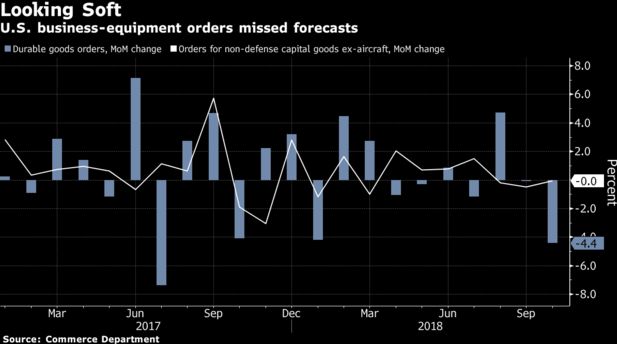

Orders placed with U.S. factories for business equipment were little changed in October, missing forecasts for a third month, Commerce Department figures showed. An index of consumer sentiment fell to a three-month low in November, according to a University of Michigan survey, while the Labor Department said filings for unemployment benefits rose last week to the highest level since late June.

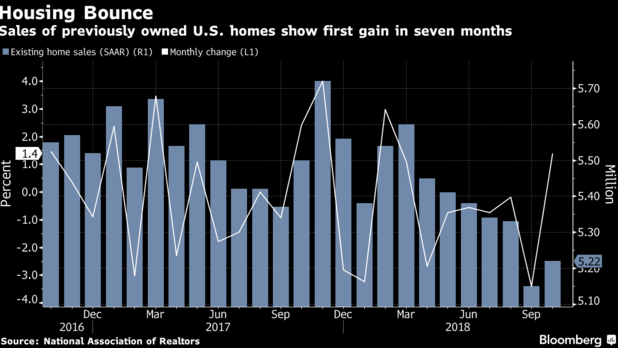

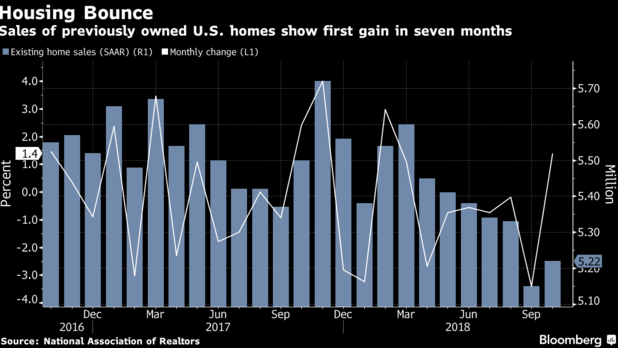

While another report showed sales of previously owned homes advanced in October, it was the first increase in seven months, a reminder that housing also may have peaked amid rising borrowing costs and high prices. With stocks erasing the year’s gains, the boost from tax cuts possibly ebbing and President Donald Trump’s trade war set to escalate, the latest data collectively point to a moderation in economic growth this quarter -- and beyond, if the weakness persists.

“The economy is losing momentum,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York. That “isn’t surprising, but nothing alarming at this stage,” and is in line with his forecast for slower growth this quarter than in the July-September period, when gross domestic product expanded at a 3.5 percent annualized rate.

Investors see the Federal Reserve as still on track for a widely anticipated quarter-point interest-rate hike in December, its fourth such move this year. At the same time, the pace of tightening in 2019 looks less certain as growth cools and the benchmark rate nears the theoretical, so-called neutral level that neither stimulates nor restrains the economy.

U.S. stocks were higher on Wednesday following two days of steep declines, as technology shares rebounded. Yields on 10-year Treasuries were also up though were still near the lowest level since early October.

Economists surveyed by Bloomberg expect growth to slow to a 2.6 percent pace in the fourth quarter, following the best back-to-back gains since 2014. It’s forecast to keep moderating, reaching a 2 percent rate in late 2019. The Atlanta Fed’s GDPNow tracker, updated after Wednesday’s data, predicts fourth-quarter growth of 2.5 percent.

What Our Economists Say...

The durable goods report suggests that the weak third-quarter investment print is more likely a trend than a one-off surprise. Momentum in core shipments -- a direct feed into investment in quarterly GDP -- decelerated last month, signaling that weakness from the third quarter is carrying over into the final quarter of the year.

Here are the details of Wednesday’s economic data:

Non-military capital goods orders excluding aircraft -- a proxy for business investment -- were little changed after a 0.5 percent decline in September that was worse than previously reported. The median forecast in a Bloomberg survey called for a 0.2 percent gain.

The University of Michigan’s sentiment index dropped to 97.5, the lowest level since August, from the prior month’s 98.6. The median estimate of economists was 98.3, which was also the preliminary reading released earlier this month.

Jobless claims increased by 3,000 to 224,000 in the week ended Nov. 17, potentially reflecting holiday-related volatility and California wildfires in what otherwise has been a strong labor market.

Existing-home sales rose from the prior month to an annual rate of 5.22 million, the National Association of Realtors said. While that narrowly exceeded economists’ projections for sales of 5.2 million, the pace was down 5.1 percent from a year earlier, the biggest drop since 2014.

“The main signal from all the data in aggregate is that growth peaked in the second and third quarter,” said Michael Gapen, chief U.S. economist at Barclays Plc. “What I would caution is that, that doesn’t mean a recession is tomorrow.”

Gapen said that unlike in the previous recession, a downturn in housing is likely to be more a symptom of a cooling economy than a cause. And even with the latest weakness, the factory-orders data are still showing “pretty decent growth,” just not as strong as before, he said.

— With assistance by Alister Bull, Jordan Yadoo, Chris Middleton, and Kristy Scheuble

Deutsche Bank Lost $60MM On Trade Meant To Minimize Risk

11/21/2018 - 10:59

While Deutsche Bank may have a far greater headache now that it has been implicated as an accomplice in Danske Bank's giant money-laundering efforts, helping some $150 billion in funds transit out of Europe illicitly, in an amusing tangent showing how the biggest, and most troubled, German lender can seemingly get nothing right these days, the most troubled German lender had put on a hedge to minimize risk at its U.S. equities business. Instead, the company lost tens of millions on the trade.

According to Bloomberg, Deutsche Bank's New York traders pooled billions of dollars of positions into one portfolio, known as a central risk book, in an attempt to avert losses and potentially make more money (or maybe in hopes of recreating JPM's London Whale "hedging" behemoth). Alas, it did not work out quite as expected, and the trade backfired leading to a $60 million loss, and forcing Deutsche Bank to slash the book’s size.

A reversal of the "pod" or silo strategy popularized by such hedge funds as Millennium and SAC, central risk books have become a trend at some of the world’s biggest investment banks which have been seeking to minimize risk exposure. As Bloomberg explains, instead of dozens of workers across numerous desks working to limit possible losses, trades are transferred to a single CRB where they are managed by a small team, often with the help of complex algorithms.

But at Deutsche Bank, part of that strategy "didn’t perform as well as desired"... which considering the bank's recent "successes" in equity trading was to be expected, and judging by the bank's response, desired:

While the size of the loss was manageable for one of Europe’s top investment banks, it represents a new glimpse into Deutsche Bank’s problems both at its equities business, which has reported quarterly declines in revenue since 2015, and in the U.S., where the Fed has been scrutinizing its controls.

Adding insult to injury, CEO Christian Sewing has targeted the stocks division for cutbacks since he took the top job in April.

Some more details from Bloomberg on the evolution of Deutsche's CRB:

While CRBs are meant to allow banks to cut costs, improve profit and bolster risk management, this particular strategy floundered, partly because of issues with the CRB’s technology, the sources said, and as Bloomberg explains, one of the problems was how well the team’s algorithms analyzed the trading success of counterparties. Another source said that the CRB may also have become "too big to manage properly."

Ryan O’Sullivan, a trader who helped oversee the strategy, moved to the role of global co-head of electronic equities in May of this year, according to his LinkedIn page. Amusingly, according to McHugh, the DB spokeswoman, "he was promoted" confirming that all one needs to do to get to the top at the German bank is lose tens of millions.

And so with this latest failed attempt to prove to the world that its equities trading desk is competitive now safely in the rearview mirror, Deutsche Bank can focus on what truly matters: defending itself from the upcoming accusations that it helped Russians launder - by way of Danske Bank - some $150 billion in "hot money" into the US.

Amazon says it has experienced a data breach just hours before Black Friday

9:48 AM, Nov 21, 2018

Just as tens of millions of Americans are preparing to start their Black Friday shopping, the nation's largest retailer has admitted to a new data breach — but it's making only a few details public.

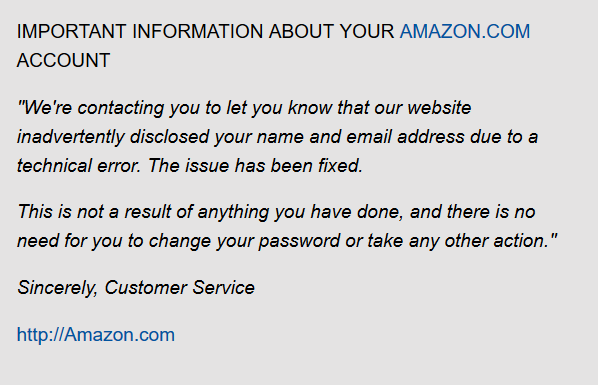

Amazon customers across the U.S. and in Europe report receiving a strange email, that appears to be a phishing scam.

An example of the email is listed below.

Some tech blogs speculate that the email is a phishing scam, because of the way it is worded. In addition, the email asks users to not change their passwords, and the email signature that includes an "http" iURL instead of an "https" (which means the URL is secure).

But Amazon has confirmed to the The Register UK and The London Telegraph that the email and breach are real. Companies are required under British law to report any data breaches immediately, well before US law requires them to divulge an issue.

However, American customers are also reporting they have received the email.

What you should do

Amazon is not sharing how many customers were affected, if any information beyond email addresses were shared, and whether the company was hacked.

Coming just one day before the start of Black Friday shopping, it is concerning.

Several security experts suggest that user change their password anyway if they have received this cryptic message from Amazon.

November 21, 2018, 6:03 PM GMT+1

Weaker-than-projected reports Wednesday on business investment, consumer confidence and the job market signaled the U.S. economy is shifting into a lower gear, leaving less cheer as Americans head into the Thanksgiving holiday weekend.

Orders placed with U.S. factories for business equipment were little changed in October, missing forecasts for a third month, Commerce Department figures showed. An index of consumer sentiment fell to a three-month low in November, according to a University of Michigan survey, while the Labor Department said filings for unemployment benefits rose last week to the highest level since late June.

While another report showed sales of previously owned homes advanced in October, it was the first increase in seven months, a reminder that housing also may have peaked amid rising borrowing costs and high prices. With stocks erasing the year’s gains, the boost from tax cuts possibly ebbing and President Donald Trump’s trade war set to escalate, the latest data collectively point to a moderation in economic growth this quarter -- and beyond, if the weakness persists.

“The economy is losing momentum,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York. That “isn’t surprising, but nothing alarming at this stage,” and is in line with his forecast for slower growth this quarter than in the July-September period, when gross domestic product expanded at a 3.5 percent annualized rate.

Investors see the Federal Reserve as still on track for a widely anticipated quarter-point interest-rate hike in December, its fourth such move this year. At the same time, the pace of tightening in 2019 looks less certain as growth cools and the benchmark rate nears the theoretical, so-called neutral level that neither stimulates nor restrains the economy.

U.S. stocks were higher on Wednesday following two days of steep declines, as technology shares rebounded. Yields on 10-year Treasuries were also up though were still near the lowest level since early October.

Economists surveyed by Bloomberg expect growth to slow to a 2.6 percent pace in the fourth quarter, following the best back-to-back gains since 2014. It’s forecast to keep moderating, reaching a 2 percent rate in late 2019. The Atlanta Fed’s GDPNow tracker, updated after Wednesday’s data, predicts fourth-quarter growth of 2.5 percent.

What Our Economists Say...

The durable goods report suggests that the weak third-quarter investment print is more likely a trend than a one-off surprise. Momentum in core shipments -- a direct feed into investment in quarterly GDP -- decelerated last month, signaling that weakness from the third quarter is carrying over into the final quarter of the year.

Here are the details of Wednesday’s economic data:

Non-military capital goods orders excluding aircraft -- a proxy for business investment -- were little changed after a 0.5 percent decline in September that was worse than previously reported. The median forecast in a Bloomberg survey called for a 0.2 percent gain.

The University of Michigan’s sentiment index dropped to 97.5, the lowest level since August, from the prior month’s 98.6. The median estimate of economists was 98.3, which was also the preliminary reading released earlier this month.

Jobless claims increased by 3,000 to 224,000 in the week ended Nov. 17, potentially reflecting holiday-related volatility and California wildfires in what otherwise has been a strong labor market.

Existing-home sales rose from the prior month to an annual rate of 5.22 million, the National Association of Realtors said. While that narrowly exceeded economists’ projections for sales of 5.2 million, the pace was down 5.1 percent from a year earlier, the biggest drop since 2014.

“The main signal from all the data in aggregate is that growth peaked in the second and third quarter,” said Michael Gapen, chief U.S. economist at Barclays Plc. “What I would caution is that, that doesn’t mean a recession is tomorrow.”

Gapen said that unlike in the previous recession, a downturn in housing is likely to be more a symptom of a cooling economy than a cause. And even with the latest weakness, the factory-orders data are still showing “pretty decent growth,” just not as strong as before, he said.

— With assistance by Alister Bull, Jordan Yadoo, Chris Middleton, and Kristy Scheuble

Deutsche Bank Lost $60MM On Trade Meant To Minimize Risk

11/21/2018 - 10:59

While Deutsche Bank may have a far greater headache now that it has been implicated as an accomplice in Danske Bank's giant money-laundering efforts, helping some $150 billion in funds transit out of Europe illicitly, in an amusing tangent showing how the biggest, and most troubled, German lender can seemingly get nothing right these days, the most troubled German lender had put on a hedge to minimize risk at its U.S. equities business. Instead, the company lost tens of millions on the trade.

According to Bloomberg, Deutsche Bank's New York traders pooled billions of dollars of positions into one portfolio, known as a central risk book, in an attempt to avert losses and potentially make more money (or maybe in hopes of recreating JPM's London Whale "hedging" behemoth). Alas, it did not work out quite as expected, and the trade backfired leading to a $60 million loss, and forcing Deutsche Bank to slash the book’s size.

A reversal of the "pod" or silo strategy popularized by such hedge funds as Millennium and SAC, central risk books have become a trend at some of the world’s biggest investment banks which have been seeking to minimize risk exposure. As Bloomberg explains, instead of dozens of workers across numerous desks working to limit possible losses, trades are transferred to a single CRB where they are managed by a small team, often with the help of complex algorithms.

But at Deutsche Bank, part of that strategy "didn’t perform as well as desired"... which considering the bank's recent "successes" in equity trading was to be expected, and judging by the bank's response, desired:

“Looking at isolated losses in central risk books is misleading since it does not take into account other related trading books or offsetting factors such as commissions earned,” Kerrie McHugh, a spokeswoman for Deutsche Bank in New York, said in an e-mail. She declined to elaborate on specifics.

While the size of the loss was manageable for one of Europe’s top investment banks, it represents a new glimpse into Deutsche Bank’s problems both at its equities business, which has reported quarterly declines in revenue since 2015, and in the U.S., where the Fed has been scrutinizing its controls.

Adding insult to injury, CEO Christian Sewing has targeted the stocks division for cutbacks since he took the top job in April.

Some more details from Bloomberg on the evolution of Deutsche's CRB:

Executives at the firm started increasing the size of the CRB for the U.S. equities business in late 2016 and continued until this year, when it contained about 2 billion euros ($2.3 billion) of trades, the people said. One person said the pool contained positions in both common stock and equity derivatives, complex contracts that derive their value from shares.

While CRBs are meant to allow banks to cut costs, improve profit and bolster risk management, this particular strategy floundered, partly because of issues with the CRB’s technology, the sources said, and as Bloomberg explains, one of the problems was how well the team’s algorithms analyzed the trading success of counterparties. Another source said that the CRB may also have become "too big to manage properly."

Deutsche Bank executives have since shrunk the size of the CRB to about several hundred million euros, the people said.

Ryan O’Sullivan, a trader who helped oversee the strategy, moved to the role of global co-head of electronic equities in May of this year, according to his LinkedIn page. Amusingly, according to McHugh, the DB spokeswoman, "he was promoted" confirming that all one needs to do to get to the top at the German bank is lose tens of millions.

And so with this latest failed attempt to prove to the world that its equities trading desk is competitive now safely in the rearview mirror, Deutsche Bank can focus on what truly matters: defending itself from the upcoming accusations that it helped Russians launder - by way of Danske Bank - some $150 billion in "hot money" into the US.

Amazon says it has experienced a data breach just hours before Black Friday

9:48 AM, Nov 21, 2018

Just as tens of millions of Americans are preparing to start their Black Friday shopping, the nation's largest retailer has admitted to a new data breach — but it's making only a few details public.

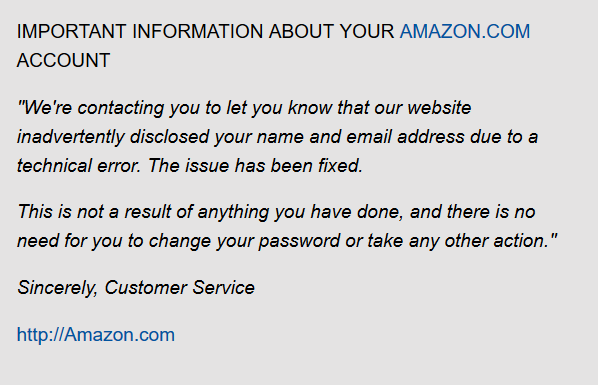

Amazon customers across the U.S. and in Europe report receiving a strange email, that appears to be a phishing scam.

An example of the email is listed below.

Some tech blogs speculate that the email is a phishing scam, because of the way it is worded. In addition, the email asks users to not change their passwords, and the email signature that includes an "http" iURL instead of an "https" (which means the URL is secure).

But Amazon has confirmed to the The Register UK and The London Telegraph that the email and breach are real. Companies are required under British law to report any data breaches immediately, well before US law requires them to divulge an issue.

However, American customers are also reporting they have received the email.

What you should do

Amazon is not sharing how many customers were affected, if any information beyond email addresses were shared, and whether the company was hacked.

Coming just one day before the start of Black Friday shopping, it is concerning.

Several security experts suggest that user change their password anyway if they have received this cryptic message from Amazon.