Thanks for starting this thread,

@Revolucionar. Was thinking there should be one after posting in The Great Reset thread on the SVB collapse. So many threads cross-over now, anyway here’s comes the “collapse” or slow reconfiguration…

From my vantage point, working in logistics, a day doesn't go by where customers are asking us to help "optimize their workflow" which is just another way of saying need to do more with less people. And leadership openly calls the current economic state we're in a recession. So, the supply chain space is going to see a lot more consolidation, reconfiguring, and deep restructuring. Here’s one example:

Regarding the latest banking failures; since these have been referred to as "regional banks" being downgraded, close to collapse, etc, people apparently are moving their money to the bigger banks thinking they are safer - which sounds completely asinine!

In 2008 after the collapse the first thing I did was move my money into a local credit union or community based banks that invest locally. So far that hasn’t been a bad idea, only time will tell.

Articles all over MSM have been blasted with these headlines:

Regional banks are seeing flight of deposits to too-big-to-fail megabanks

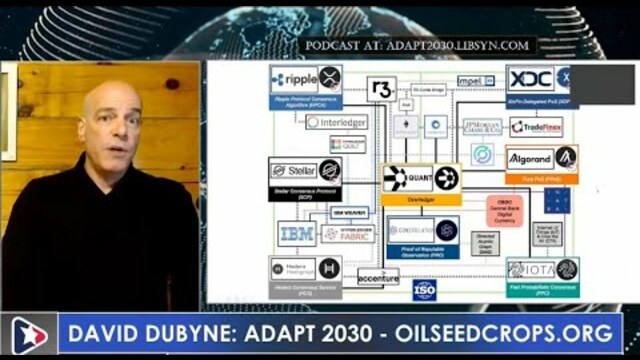

I get the sense that the PTBs who are vested in a digital currency are corralling or “nudging” people to seek refuge into these big banks. Once the banks have enough accounts, through bait and switch incentives, they’ll flip to a digital currency.

It’ll take a disaster for them to implement - guessing they’ll crash the massive derivative bubble on purpose. Now with “money” basically worthless they can incentive people to trade over dollars for digital dollars and purchase goods and services through approved (ESG) corporations. Moving money out will be heavily taxed and penalized (yay, enslavement!).

Meanwhile, the parallel economy will form at the community level and multi-polar level grounded in tangible commodities, creative makers, and functional resources.

Regarding “nudging”. I ran across it in this article. It’s basically a form NLP and outlines the history and strategy to get people to do something without them feeling forced to. This was interesting:

Speaking at a 2009

Fabian Society meeting,

Ed Miliband of the British Labor Part made the following remarks about “Nudging”:

“

Remember something called Nudge. Nudge was very fashionable in the Guardian for a few months before the financial crisis. Nudge was about not really needing the state to do big things. You just need a few incentives here and there. People don’t talk about Nudge much any more.[2]

In an April 8, 2009 article The Guardian would reference George Osborne—the Chancellor of the Exchequer—discussing the importance of “Nudging”:

“Osborne said that Nudge thinking was relevant to the banking crisis because, unlike conventional economists, Thaler and Sunstein accept that people act irrationally and banking reform has to be based on the acceptance that markets are irrational too.”

By David Gosselin “Although this science will be diligently studied, it will be rigidly confined to the governing class. The populace will not be allowed to know how its convictions were gene…

canadianpatriot.org

Lastly, Redacted crew outlined the situation quite well the other day:

Just my open thoughts of what’s to come after reading some articles - a lot more to catch up on! Along with some sleep..zzz