Paul Krugman, who won a Nobel Prize in economics for his work on trade theory, seems the kind of person who might have a credible view on the various scenarios depicted by the very political Mark Carney’s report to the Treasury Committee. Krugman made some points on Twitter last night;

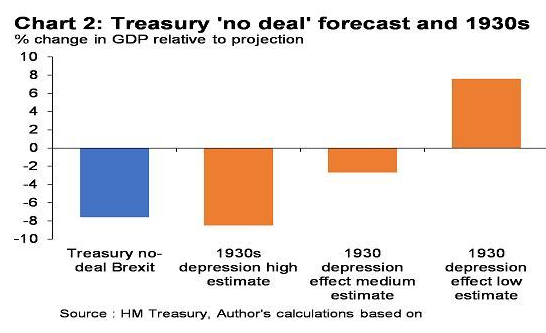

The UK Treasury has published another set of estimates of the impact of Brexit on the UK economy, claiming that in a ‘no deal’ scenario, UK GDP will be around 8% lower in the long term than it would have been if the UK remained in the EU.

If this looks to the casual observer like a big number, that is because it is. But can it be taken seriously? Simply put, no. It is a figure that fails to pass the most elementary ‘sniff test’. Below we show just how silly this projection is with reference to the UK’s experience in the Great Depression of the 1930s.

The 1930s depression was the most severe shock to hit the UK economy in the last century, featuring:

How big an effect did this shock have on long-term UK GDP, e.g. by 1938? To answer this, we need to guess what GDP ‘might have’ been in 1938 by projecting GDP in 1929 (before the shock) forwards using plausible ‘no depression’ growth rates. We choose three possible growth rates to do this projection –

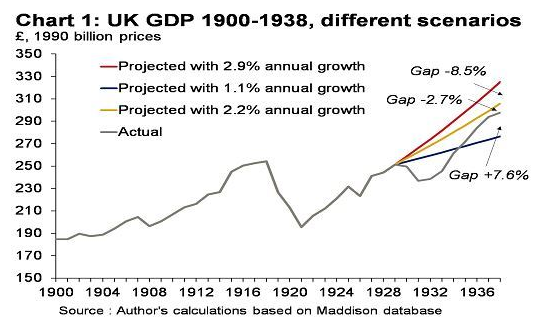

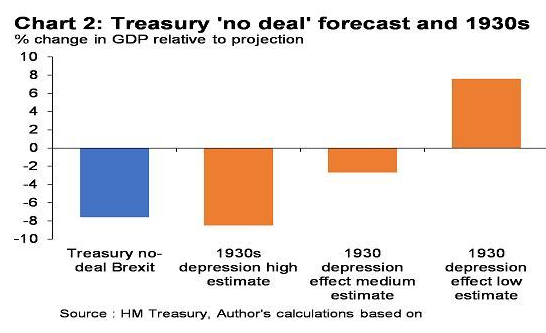

If we assume UK growth would have been 2.9% per year from 1929-38, then UK actual GDP in 1938 was around 8% below the ‘projected’ level. If we instead assume UK growth would have been 2.2% per year in a ‘no depression’ world, then actual UK GDP in 1938 was around 3% below the ‘projected’ level. Finally, if we assume UK growth would have been 1.1% per year in 1929-38 without the depression then actual UK GDP growth was actually about 8% higher than the projected level (see Chart 2).

So, in the first scenario we get a similar negative effect on UK GDP as the Treasury is now forecasting for a no deal Brexit. But this scenario used a very unrealistic estimate of what UK GDP growth would have looked like in the 1930s without the depression – the 1922-29 period was not only a global boom period but also saw the UK recovering from a deep recession after World War 1. The middle scenario, which yields a 3% long-term GDP loss by 1938, is far more realistic.

Moreover, the scale of the economic shock suffered by the UK in the 1930s was much bigger than any plausible Brexit-related shock could be. The depression tariff shock alone was double the equivalent shock the UK would suffer from moving to trading with the EU on WTO terms.

So, the Treasury’s 8% GDP loss for a ‘no deal’ Brexit is equivalent to the worst estimate you can make for long-term UK GDP losses after the worst financial and economic shock of the last century, and more than double more realistic estimates of the long-term GDP loss the UK suffered in the 1930s. It is very silly indeed. Many will think that it is worse than silly: that it is a deliberate attempt to mislead and alarm.

- The Bank of England just released some very dire scenarios.

- But their bad-case losses from a no-deal Brexit look extremely high. I mean, 8% of GDP was the kind of estimate we used to make for countries with 150 percent effective rates of protection.

- I don’t understand how you can get that kind of cost without making some big ad hoc assumptions about productivity or something. And I have worried in all this about motivated reasoning on the part of people who oppose Brexit for the best of reasons.

- As best I can tell, the big results depend on assumed relations between trade/FDI flows and productivity. It’s really important to understand that this channel does not follow from basic trade theory and comparative advantage; it’s a black-box story.

- What we have are correlations between trade and investment flows and productivity that don’t really follow from standard models. Are these causal? There is surely room for skepticism. Yet that seems to be the big driver of the whole thing. So I’m worried.

- Again, I’m anti-Brexit, and have no doubt that it will make Britain poorer. And the BoE could be right about the magnitude. But they’ve really gone pretty far out on a limb here.

The UK Treasury has published another set of estimates of the impact of Brexit on the UK economy, claiming that in a ‘no deal’ scenario, UK GDP will be around 8% lower in the long term than it would have been if the UK remained in the EU.

If this looks to the casual observer like a big number, that is because it is. But can it be taken seriously? Simply put, no. It is a figure that fails to pass the most elementary ‘sniff test’. Below we show just how silly this projection is with reference to the UK’s experience in the Great Depression of the 1930s.

The 1930s depression was the most severe shock to hit the UK economy in the last century, featuring:

- A huge demand shock to exports: world trade volume fell by 30% from 1929-32. UK export volume fell 40% from 1929-32.

- A huge rise in trade costs: protectionist actions drove up the average world tariff by seven percentage points from 1929-31 to over 20% (this would have applied to around half of UK exports at the time). This understates the degree of protectionism because many countries brought in import quotas and restricted access to foreign currency (to buy imports with) too.

- A massive financial shock: the UK stock market fell by 40% from 1929-32

- A bad policy response: the UK authorities initially reacted to the slump by tightening fiscal policy and raising interest rates. Real interest rates (interest rates minus inflation) rose from 5% in 1928 to an eye-watering 10% by 1931.

How big an effect did this shock have on long-term UK GDP, e.g. by 1938? To answer this, we need to guess what GDP ‘might have’ been in 1938 by projecting GDP in 1929 (before the shock) forwards using plausible ‘no depression’ growth rates. We choose three possible growth rates to do this projection –

- Average UK growth from 1922-29 (2.9% per year)

- Average UK growth from 1900-29 excluding WWI and the period just after it (2.2% per year)

- Average UK growth for all years from 1900-29 (1.1% per year)

If we assume UK growth would have been 2.9% per year from 1929-38, then UK actual GDP in 1938 was around 8% below the ‘projected’ level. If we instead assume UK growth would have been 2.2% per year in a ‘no depression’ world, then actual UK GDP in 1938 was around 3% below the ‘projected’ level. Finally, if we assume UK growth would have been 1.1% per year in 1929-38 without the depression then actual UK GDP growth was actually about 8% higher than the projected level (see Chart 2).

So, in the first scenario we get a similar negative effect on UK GDP as the Treasury is now forecasting for a no deal Brexit. But this scenario used a very unrealistic estimate of what UK GDP growth would have looked like in the 1930s without the depression – the 1922-29 period was not only a global boom period but also saw the UK recovering from a deep recession after World War 1. The middle scenario, which yields a 3% long-term GDP loss by 1938, is far more realistic.

Moreover, the scale of the economic shock suffered by the UK in the 1930s was much bigger than any plausible Brexit-related shock could be. The depression tariff shock alone was double the equivalent shock the UK would suffer from moving to trading with the EU on WTO terms.

So, the Treasury’s 8% GDP loss for a ‘no deal’ Brexit is equivalent to the worst estimate you can make for long-term UK GDP losses after the worst financial and economic shock of the last century, and more than double more realistic estimates of the long-term GDP loss the UK suffered in the 1930s. It is very silly indeed. Many will think that it is worse than silly: that it is a deliberate attempt to mislead and alarm.