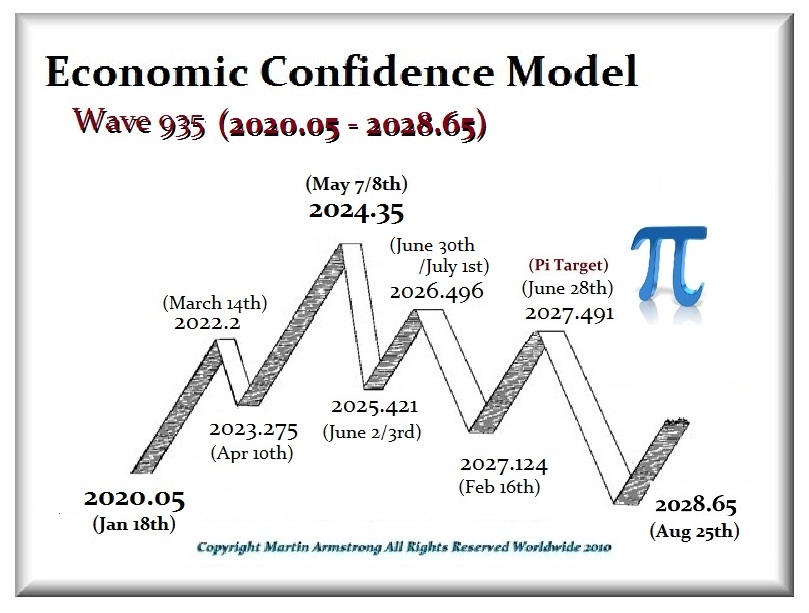

The speaker discusses the current state of financial markets, particularly in the US and the US Stock Market. He begins by quoting John Kenneth Galbraith on the psychology of speculation and the euphoria that can distort markets. The speaker notes that despite growing awareness of economic weaknesses, such as a national debt crisis, political instability, and geopolitical tensions, some investors remain complacent. He identifies two contrasting views on the economy's strength, with one group pointing to strong GDP numbers and corporate earnings, while the other sees warning signs and systemic risks. The speaker argues that the financialization process, which began in the 1970s, has nearly completed the transformation of America from an economy with a financial system to a financial system with an economy. The top 50% of income earners in the US own 94% of the assets, and they do 85% of the spending, which the speaker believes explains why the balance sheets and earnings of many companies remain strong.

Macgregor discusses the growing economic disparity between upper and lower income brackets, attributing it to the consistent increase in asset values for the wealthy over several decades. He warns that a reversal of this trend could lead to major social consequences. The speaker also mentions the five richest men in the world, whose wealth has doubled in the last three years, not due to productivity but because of rising asset prices. The first warning sign of potential instability in the financial system is bank fragility, specifically referencing New York Community Bank, which has experienced significant financial losses on commercial real estate and multi-family housing loans. The speaker expresses concern about the potential for contagion and the interconnectedness of smaller banks with larger institutions, as evidenced by Moody's downgrading of New York Community Bank's credit rating to junk status. The speaker also mentions that New York Community Bank had bought up some of Signature Bank's assets during the previous banking crisis, suggesting that the problems could spread further.

Macgregor discusses the risks facing the banking system and potential economic downturn. The first warning sign is banking fragility, with unrealized losses in the banking system reaching almost a trillion dollars, which is a significant problem given the size of the US banking system. The second risk is a refinancing crisis, as the US government and commercial real estate sectors face massive refinancing needs, exacerbated by rising interest rates. The third risk is the housing market, which has experienced a significant depreciation, with every price drop of 2% or more preceding or coinciding with a recession. The fourth risk is the narrowness of investment focus in the stock market, with passive investing leading to a concentration on large companies. These risks, the speaker warns, are systemic and could lead to a severe recession or even a depression.

The speaker discusses concerning trends in the stock market, specifically the disproportionate growth of certain companies like Apple and Microsoft, whose market capitalizations have surpassed entire sectors of the S&P 500 despite stagnant or declining fundamentals. The speaker warns that this narrow concentration of investment and the speculative mania surrounding companies like Apple, driven by themes such as artificial intelligence, could lead to a dangerous bubble. The speaker also expresses skepticism about the productivity miracle promised by AI and questions whether it can offset economic challenges like the housing crisis, commercial real estate refinancing, and government debt. Ultimately, the speaker believes that we are in the final stages of this speculative mania, which could end badly and impoverish a significant portion of the population. The speaker advises investors to be cautious and consider taking profits, emphasizing that these bubbles always end in a massive euphoric burst.

dailyhodl.com

dailyhodl.com