Yep, you could start with Antifragile, then go from there if you feel like it.

Great, I'll be reading it.

Yep, you could start with Antifragile, then go from there if you feel like it.

Oh boy, you can say that again. That was not an easy story to tell for you two, and not easy to hear, and yet the reality is as armies sweep back and forth in time, there are many Battalion 101's who answer the call against many people who met these horrendous fates. As JP said, almost anyone is capable, yet there are plenty of nuances with choices that can be exercised - and then what that means (which you cover).

Yep, you could start with Antifragile, then go from there if you feel like it.

BTW, here's the embedded YouTube video for the show:

Can't say I agree with all of his points on everything, especially how black swans just cannot be predicted (and other such things). The problem really is, as Laura has covered, the sheer level of idiocy and the prophecy 400:1 ratio. So it's not that they can't be predicted, but rather that only very few are gifted to predict them, and even then as soon as the majority believe their prediction, reality changes so that it no longer happens as/when expected.

A judge walks out of his chambers laughing his head off. A colleague approaches him and asks why he is laughing.

"I just heard the funniest joke in the world!"

"Well, go ahead, tell me!" says the other judge.

"I can't - I just gave someone ten years for it!"

With the fall of communism in the Soviet Union and Eastern Europe, the world lost one of humanity's greatest cultural productions: the communist joke. Crossing cultures and borders, the jokes were unique, ubiquitous, and jam-packed with information. They were funny too. The mix of totalitarian power, propaganda, censorship, and ineptitude created the perfect climate for an underground joke-telling tradition.

In his book, Hammer and Tickle, Ben Lewis tracks down all the best jokes from the era, providing not only a handy compendium, but a cultural history of communism in the process. As communism changed, so did the jokes, revealing the different experiences and attitudes of the people during the times of Lenin, Stalin, Khrushchev, and then into the stagnation of the Brezhnev years and finally the collapse of the Soviet Union.

Note, MindMatters will be back in January. Merry Christmas, everyone!

That seems true enough. I do hope you get to read the book though (if you haven't already) so that you get a better sense of just how much Taleb qualifies what he says. Perhaps if enough people are interested, we can start a separate thread about it - with a focus on the parts that speak to his central thesis and what that means for how we can potentially become stronger.

As for Ray Dalio, while I have no doubt that he has probably benefited personally from making negative predictions and shorting the market as a result of the psychology he would have induced in investors, he has said a number of things recently that do seem consistent with a lot of trends and probable outcomes we mostly only read about from 'alternative sources'. I suppose he's made such a splash recently because he represents the monied class to some large degree, and has been so outspoken about where things seem to be going.

"Clearly, asset prices today whether it's US stocks or its interest rates or its the dollar it's all priced off of, in my opinion, a 5% budget deficit with this incredibly overly stimulative fiscal policy combined with overly stimulating monetary policy is creating this US exceptionalism that, one day, like if we normalized our deficit to levels more popular in Europe, we'd see completely different valuations for the sock market...the dollar...etc."

Because the "trickle-down" process of having money at the top trickle down to workers and others by improving their earnings and creditworthiness is not working, the system of making capitalism work well for most people is broken.

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.” The Rothschild brothers of London writing to associates in New York, 1863.

Perhaps it is harsh to paint the man as just another lowlife charlatan. However there is a wide gulf between making a general statement on the world and the economy, and making specific predictions that people will follow.

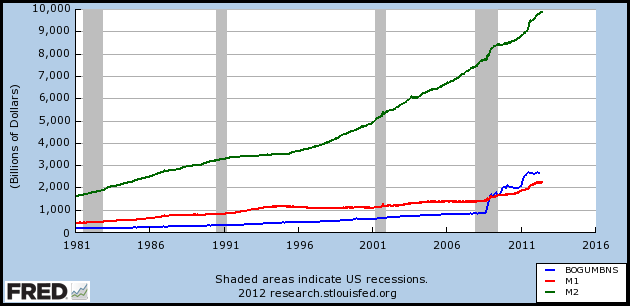

For the last decade he has been telling us a crash is just around the corner. But just putting his predictions on a chart (not actually such a bad indicator of the US economy in general), he has been dead wrong, and if anyone actually took his advice (i.e. stay out of the stock market or short it), they have clearly just missed a massive opportunity to build wealth for themselves, their families and their communities.

And now yet again he's saying it's over. If a doctor tells you the wrong answer for 10 years it's not so wise to go back to him for his opinion yet again.

As money is divided infinitely and approaches zero, assets priced in money approach infinity. Through endless issuance of debt, owners of assets leverage those assets through this finance to create more assets. This expansion goes on until a situation occurs where enough assets are created in the hands of people whereby it's time for the ultimate owners to pull the plug on this credit, crash those asset prices back towards zero and take ownership of them once whoever got caught holding the bag is liquidated.

Thing is, not many people really have assets right now, so the timing doesn't seem quite right. What you'd need is a dot-com scale melt-up to really get everyone on board and shaken out of their deep pessimism, and to erase those like Dalio and zerohedge who bet against it with awful timing. Everyone who is skeptical of the economy and the market now is future demand for when things get really crazy, just before they pull the plug, just as it always goes.

That assumes that they know that the market is a massive bubble though, and would sell out at the right time. Given much of the news by the MSM - that repeats how well things are going, it seems to me that all too many will lose their pensions and their pants unless they know about what's very likely coming. And most do not. So while I agree that specific predictions are silly, I don't think making a point of giving warning is a bad idea for those who have ears to hear.

He is far from alone in doing so however. Many observers outside of the corporate news have been scratching their heads for years at how inflated and tenuous the whole system is; almost in wonderment at how things have continued for as long as they have already. Also, considering the depth and breadth of the potential fallout, helping inure people to the hopium of some markets seems to me like something of a service.

I'm not clear on what you mean by the above.

Great, I'll be reading it.

Ugh! I knew Taleb didn't like Peterson, but that was out of line.Taleb tweeted this yesterday. By "psycholophaster", a word he derived from philosophaster - a person engaging in shallow or pretentious philosophizing - he means to call Peterson a "charlatan psychologist"

medium.com

medium.com

OK this is super interesting but I don't wanna take over the thread with just one point from one show and briefly summarize

For sure warning people of potential dangers is noble, but to an extent.

I liken it to climate change in that we are told to be mega fearful of human-caused stupidity and the inevitable disaster (which is in part true), however ignoring the natural cycle and knowledge that would actually help people. People wanna say sometimes the economy is a "bubble" and sometimes "real growth", but really it follows this natural cycle of expansion and contraction like anything else in the universe.

Yeah, it's good to warn a child of the dangers of death, but not in such a hysterical fashion that he/she becomes to afraid to participate in life. And that is, in my opinion, what is being done to people - it's an absolute mind job. It causes head-scratching in those whose bias (based on necessarily limited info) says that the market should be going down. But its going up, so I mean they've been wrong so far. How many times can you be wrong and still be called an expert? The answer is: infinite.

Yeah, it's good to warn a child of the dangers of death, but not in such a hysterical fashion that he/she becomes to afraid to participate in life.

And that is, in my opinion, what is being done to people - it's an absolute mind job. It causes head-scratching in those whose bias (based on necessarily limited info) says that the market should be going down. But its going up, so I mean they've been wrong so far. How many times can you be wrong and still be called an expert? The answer is: infinite.

Timing matters in these things a lot. It was only this year that it started to really accelerate. The fed made the unprecedented move of announcing that they will sustain the "expansion" at all costs. Pundits actually being out there actually telling people to bet against the fed is insane. It could have a lot more juice in it and keep going up for another 5 or even 10 years until the cycle has run its course.

Warning someone of potentially dangerous tornadoes can be very useful. But continually warning them, falsely, of impending tornadoes every day for years is not responsible, because when the tornado finally comes for their house they will have stopped listening and assume you're full of it. The doomsayers don't know it yet but they are actively participating in and fueling the emotional environment that allows for these kind of crashes. Also there are real risks to holding cash or gold etc. in the wrong phase - they will both become steadily worth less and less relatively.

If it does continue going up, all those who sat on the sidelines fearfully will feel cheated, and after seeing others make crazy gains will be motivated to buy in even higher, at dangerously high prices. "Screw this, I'm not listening to Dalio anymore!". And that's when the whole thing is in trouble. But that's the way it always goes and it seems there's no way to fight the cycle, just as there's no way to fight the cycle of the rise and fall of societies, the phases of the moon or the changes in our climate. We just get to learn and watch them repeat helplessly

While the ancient philosophy of Stoicism is experiencing a comeback, many are still unfamiliar with some of its more esoteric concepts, like the role of pneuma or spirit in cosmology. The primal stuff of the cosmos - informing matter and mind at different levels of tension - for the Stoics, pneuma is the alpha and omega, the beginning and end of the cosmos.

Today on MindMatters, we take a look at some of the basics of Stoic cosmology, how it informs their ethics, and the role it had on early Christian theology, specifically in the letters of Paul. For Paul the Holy Spirit actually has more in common with the Stoic Divine Pneuma than you might think, and has some far-out implications for what Paul thought about things like the "resurrection", "pneumatic" bodies, and the growth of knowledge and being.

What good is philosophy? For the Stoics, among other schools, philosophy is dead if it is not fully lived. That's why the Stoics presented not just a system of logic and cosmology, but also a way of living - to put into practice the principles on which the system is built. But while the Stoic schools that taught this way of life died out many years ago, that doesn't mean that Stoicism is no longer an option for people today. Stoicism has experienced a revival in recent years.

Today on MindMatters we take a look at one modern presentation of practical Stoicism, laid out in William B. Irvine's Guide to the Good Life, as well as complementary methods and practices from other systems, like G. I. Gurdjieff's "Fourth Way." Whether you go "full Stoic", like Irvine, or merely adopt some of their practices to integrate into your daily life, there's a lot to learn from the Stoic sages of old, and their modern interpreters.