And Bitcoin is finite. Historically, the PTB like creating money out of thin air. Are they really going to be happy with a very finite supply of Bitcoin?

Practically, it's not very feasible given human nature, the nature of the PTB, and human history in general.

This is the key. But it is nothing new. Money with an expiration date.

There is a very old story behind the idea, and it will reveal what problems cryptocurrencies have.

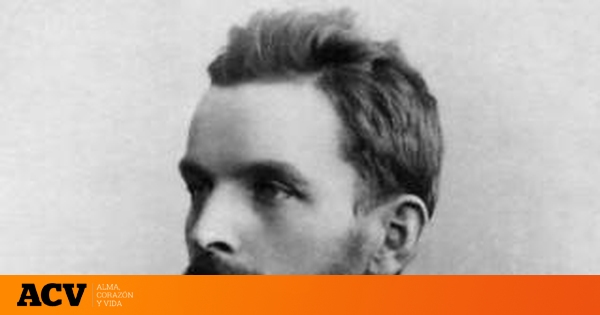

El economista de moda que inventó el dinero que caduca

Aunque lleva décadas en el olvido, Silvio Gesell vaticinó una teoría que podría servir en la actualidad para enfrentar futuras crisis

"Adored by Keynes".

The fashionable economist who invented the money that expires

Although he has been forgotten for decades, Silvio Gesell predicted a theory that could be used today to face future crises.

He was a curious mixture, half Argentinean and German. Jean Silvio Gesell was born in Belgium (although it was then part of Germany) in 1862 and was the seventh of nine children in a family that was not characterized by its economic ease. His lack of resources prevented him from attending university, so he ended up working as an apprentice in commerce with his brother in Berlin, although he also went to Malaga or Argentina, fleeing from poverty.

Seen in this light, it is natural to think that he was not a great admirer of money. He witnessed a massive financial collapse in 1890 that convinced him that behind the mighty gentleman that is money there was also a darker side: poverty, inequality, unemployment or stagnation. The problem - he concluded - was that money fulfilled two conflicting functions: one is the way people store wealth and the other is what they need to do business.

An ephemeral money

In 1889, as a result of this crisis coinciding with the government of Juárez Celman in Argentina, he began to analyze the monetary system to find a solution to the crisis, and these observations would come to fruition in 1931, when he wrote his first theoretical treatise on finance: 'Die Reformation des Münzwesens als Brücke zum sozialen Staat' or, in other words, 'The reform of the monetary system as a bridge to a welfare state'. Gesell's aim was to create a new type of money so that people could not hoard it in times of crisis, out of fear, and thus paralyze business.

It would have to be a money that would rot, rust, that would not be eternal, so that people would use it as an instrument of exchange and nothing more: sealed money, a cash that had to be sealed every certain time in a public office because it would have an expiration date, in other words, it would have to be paid for so that it would not expire, so it would be sufficiently dissuasive to avoid accumulation. Keynes said in 'General Theory of Employment, Interest and Money' that in the future Gesell would be studied more than Marx and he was not wrong: after years of silence it is heard again in speeches of leaders in the Federal Reserve of the United States, research documents of the International Monetary Fund and the pages of the 'Financial Times', as explained by 'National Public Radio'.

Money that had to be paid for in order to continue to be used sounds like a radical measure, to be sure, but he was convinced of his idea. So much so that in 1899 he began to travel around Europe and Argentina spreading his gospel, in which he also advocated the end of monogamous relationships and the importance of free love. He was a bohemian and hippie utopian before these existed, who lived in a vegetarian commune near Berlin and criticized big business and finance and fascism*. However, for a long time sealed money was only a theory, and Gesell did not get to see the culmination of his work, which would come during the Great Depression, as he died of pneumonia in 1930.

*(sounds familiar right?)

In 1932, the city of Wörgl in Austria began issuing stamped money as a way to combat unemployment and business closures. The system struggled to lift people out of poverty and was widely praised by the press at the time, which called it "The Wörgl Miracle." The experiment inspired other places in California, Iowa or Anaheim. However, with the end of World War II and industrialization, Gesell began to fall into oblivion.

So far. The world's central banks are looking at how to keep the money moving. When the economy goes into recession they usually cut interest rates to encourage spending, but interest rates are already close to zero, which could be a big problem in another recession. For a long time, economists believed that rates could not be negative for a simple reason: if saving in places like banks costs money, they will just hoard cash, which won't cost them. Cash becomes an obstacle to economic stimulus. One way around this is higher inflation, which devalues or "taxes" money in real terms, but central banks have shown that they have much less power to increase inflation than previously thought.

A solution? It is hard to say, but Europe and Japan are experimenting with very small negative interest rates as a way to stimulate the economy, the problem is the same as always: people will start hoarding cash. That is why, for the first time after so many years, Gesell is again considered relevant. The best thing is that with modern changes there would no longer be a need for a sealed money, but other ideas such as the electronic cash system or the complete elimination of paper and currency have been talked about. Not bad for a person who, fleeing from poverty, began to understand the functioning of a money he had always lacked, was branded as an anarchist, a free spirit or a crank, and of whom only Keynes had some kind words: "A strange prophet". He certainly was.