World powers continue the positioning of food resources. As global weather patterns shift!

www.cnbc.com

Published Thu, Sep 10 20201:03 AM EDT

www.cnbc.com

Published Thu, Sep 10 20201:03 AM EDT

A worker displaying soybeans imported from Ukraine at the port in Nantong, in China’s eastern Jiangsu province. - Imports of soybeans from the US, once China’s biggest supplier, have dropped massively since a trade war between the US and China began in 2018.

STR | AFP | Getty Images

Global soybean demand has been robust recently, with new American crop sales at record levels, said Jim Sutter, CEO of the U.S. Soybean Export Council.

On Tuesday, prices of U.S. soybean futures rose to their highest levels since 2018 after the U.S. Department of Agriculture said that Chinese buyers purchased 664,000 tonnes, the largest daily total since July 22.

“It looks like the outlook demand for the next six months or so is pretty good, and so I would say U.S. farmers are feeling much more optimistic than they were say, a year or even six months ago,” Sutter told CNBC’s “Street Signs Asia” on Thursday.

He argued that China snapping up U.S. soybeans indicates that the phase one trade deal between the two countries is successful.

According to the agreement signed in January, China is committed to buying $12.5 billion of American agricultural goods in 2020 and another $19.5 billion in 2021. China is the world’s largest importer of soybeans, importing 60% of the world’s soybean exports.

“I continue to believe that the phase one agreement is very important and is being executed well,” said Sutter.

While there are concerns that China may not be able to fulfill its commitments in the phase one deal, he explained that is largely due to the perception that purchases would take off immediately after the deal was done.

However, there were issues and details to be worked through and China is now actively buying soybeans at this time of the year on seasonal demand, said Sutter.

And the country’s soybean demand is likely to grow as the country’s hog herd numbers recover from a African swine fever outbreak, he said.

“Now, as we get into the time of the year, when China is more typically purchasing soybeans from the northern hemisphere — the United States in particular — we are seeing them make significant purchases ... we have a record amount of new crop sales open to China at this time, so we are thinking that it is a successful trade deal,” Sutter added.

Andrey Sizov Sep 9, 2020

Russia 2020 crop update * #Wheat and barley production estimates up , #corn – down * Autumn drought becomes an issue for 2021 crop * Domestic market could face barley oversupply More: https://sizov.report/?utm_source=tw

Farm Policy

Sep 9, 2020

Topsoil Moisture Percent Short to Very Short, Week Ending September 6th https://bit.ly/2ZQNXeJ

* #Iowa, 80% * #Nebraska, 73% * #Illinois, 57% * #Indiana, 52% * #SouthDakota, 53%

www.severe-weather.eu

09 September 2020

www.severe-weather.eu

09 September 2020

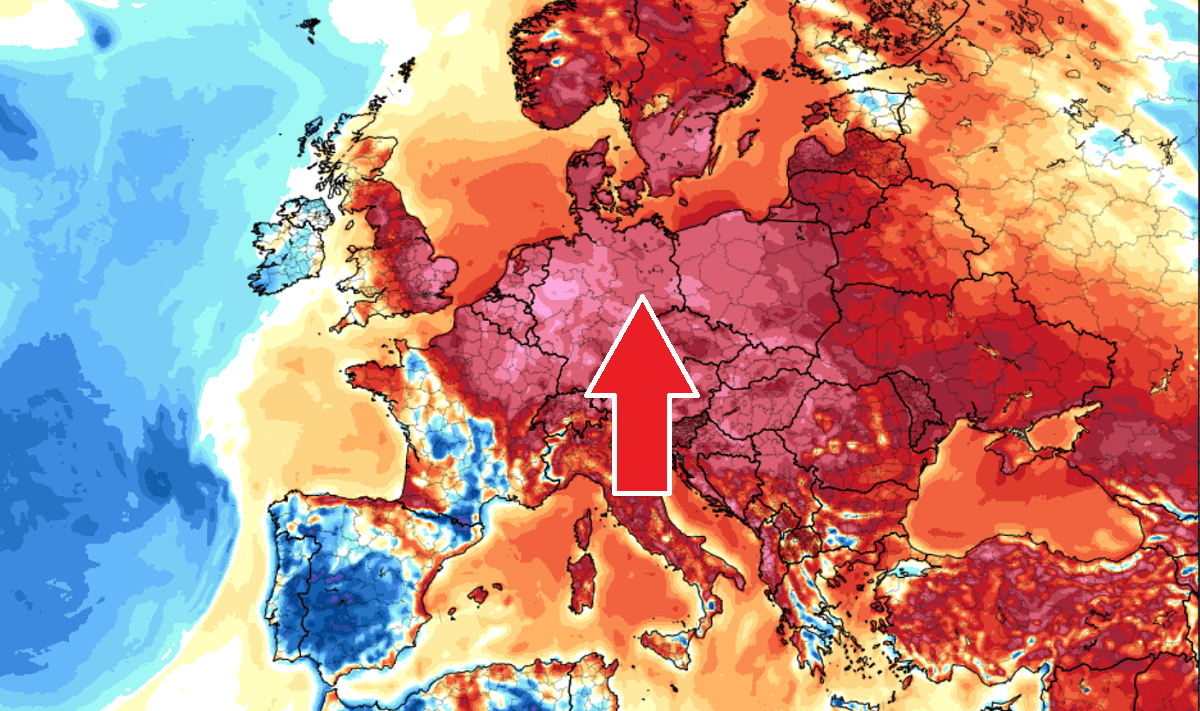

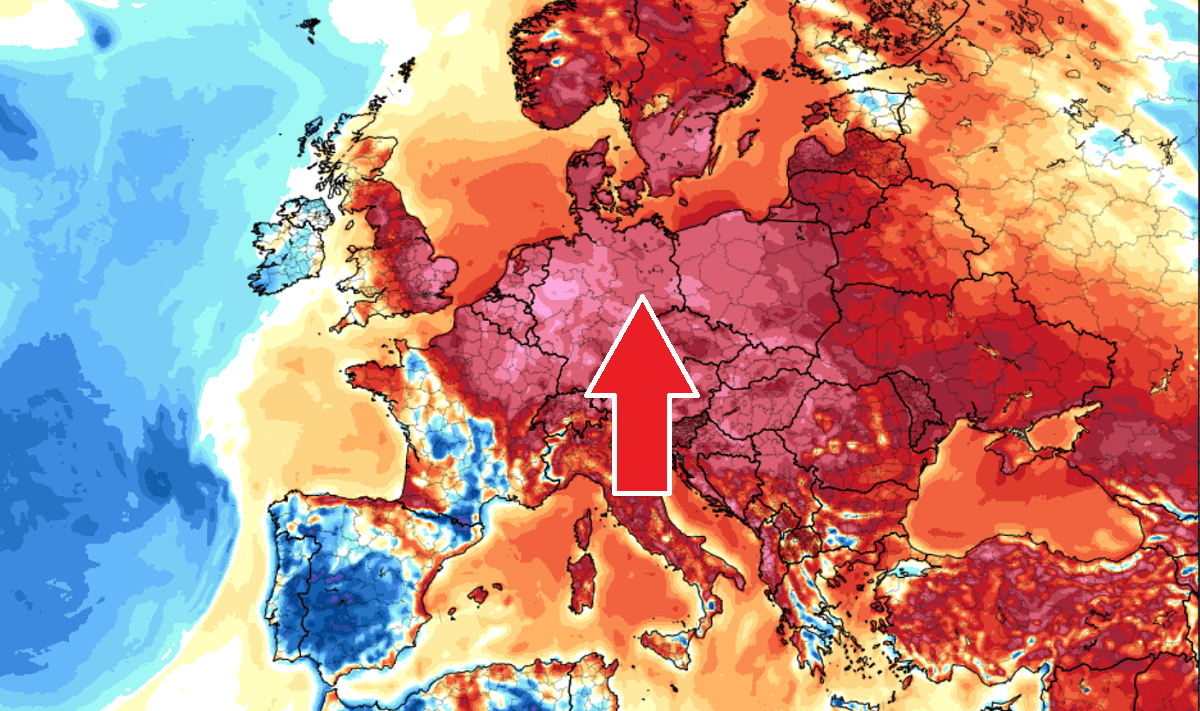

Pattern change

An extensive omega blocking pattern is expected to develop this weekend and strengthen into the next week. A powerful surface high-pressure system will spread across a large part of Europe and bring stable and very hot weather in many areas.

In response to a changing pattern, a very strong warm advection will spread from the south into central and northern Europe. It will bring a stable, around a week-long period of very warm to hot days.

aghealth.ucdavis.edu

These fires are highly destructive and can damage crops and soil, harm livestock, and create a high-risk environment for agricultural workers. In addition to the dangers of an active fire, wildfire smoke, ash, and chemicals used to treat fires negatively affect air and water quality.

aghealth.ucdavis.edu

These fires are highly destructive and can damage crops and soil, harm livestock, and create a high-risk environment for agricultural workers. In addition to the dangers of an active fire, wildfire smoke, ash, and chemicals used to treat fires negatively affect air and water quality.

Farmers and farmworkers are at a greater risk for exposure and may come into more frequent contact with wildfire ash and chemical residue due to their work outdoors and long shifts, both during an active fire and as well as during cleanup and recovery. Lost workdays can affect workers economically as well. Regardless of their proximity to wildfires, agricultural workers can struggle with stress and other mental health issues related to the effects of wildfires.

WCAHS is working with agricultural stakeholders to conduct research on the impact of wildfires on the safety and health of agricultural workers. Our research with farmers and farmworkers in the Imperial, Central, and Salinas valleys address farmers’ perceptions of the risks to their workforce and farmworkers’ perceptions of personal risk.

Soybean futures have been surging on Chinese demand, trade group CEO says buying could continue

On Tuesday, prices of U.S. soybean futures rose to their highest levels since 2018 after the U.S. Department of Agriculture said that Chinese buyers purchased 664,000 tonnes, the largest daily total since July 22.

- On Tuesday, prices of U.S. soybean futures rose to their highest levels since 2018 after the U.S. Department of Agriculture said that Chinese buyers purchased 664,000 tonnes, the largest daily total since July 22.

- “It looks like the outlook demand for the next six months or so is pretty good, so I would say U.S. farmers are feeling much more optimistic than they were a year or even six months ago,” said Jim Sutter, CEO of the U.S. Soybean Export Council

A worker displaying soybeans imported from Ukraine at the port in Nantong, in China’s eastern Jiangsu province. - Imports of soybeans from the US, once China’s biggest supplier, have dropped massively since a trade war between the US and China began in 2018.

STR | AFP | Getty Images

Global soybean demand has been robust recently, with new American crop sales at record levels, said Jim Sutter, CEO of the U.S. Soybean Export Council.

On Tuesday, prices of U.S. soybean futures rose to their highest levels since 2018 after the U.S. Department of Agriculture said that Chinese buyers purchased 664,000 tonnes, the largest daily total since July 22.

“It looks like the outlook demand for the next six months or so is pretty good, and so I would say U.S. farmers are feeling much more optimistic than they were say, a year or even six months ago,” Sutter told CNBC’s “Street Signs Asia” on Thursday.

He argued that China snapping up U.S. soybeans indicates that the phase one trade deal between the two countries is successful.

According to the agreement signed in January, China is committed to buying $12.5 billion of American agricultural goods in 2020 and another $19.5 billion in 2021. China is the world’s largest importer of soybeans, importing 60% of the world’s soybean exports.

“I continue to believe that the phase one agreement is very important and is being executed well,” said Sutter.

While there are concerns that China may not be able to fulfill its commitments in the phase one deal, he explained that is largely due to the perception that purchases would take off immediately after the deal was done.

However, there were issues and details to be worked through and China is now actively buying soybeans at this time of the year on seasonal demand, said Sutter.

And the country’s soybean demand is likely to grow as the country’s hog herd numbers recover from a African swine fever outbreak, he said.

“Now, as we get into the time of the year, when China is more typically purchasing soybeans from the northern hemisphere — the United States in particular — we are seeing them make significant purchases ... we have a record amount of new crop sales open to China at this time, so we are thinking that it is a successful trade deal,” Sutter added.

Andrey Sizov Sep 9, 2020

Russia 2020 crop update * #Wheat and barley production estimates up , #corn – down * Autumn drought becomes an issue for 2021 crop * Domestic market could face barley oversupply More: https://sizov.report/?utm_source=tw

Farm Policy

Sep 9, 2020

Topsoil Moisture Percent Short to Very Short, Week Ending September 6th https://bit.ly/2ZQNXeJ

* #Iowa, 80% * #Nebraska, 73% * #Illinois, 57% * #Indiana, 52% * #SouthDakota, 53%

Indian summer through mid-September as extreme heatwave develops across Europe

Indian summer with hot weather is expected to develop over the weekend into next week. Temperatures should locally climb into the 30-36 °C range again.

Pattern change

An extensive omega blocking pattern is expected to develop this weekend and strengthen into the next week. A powerful surface high-pressure system will spread across a large part of Europe and bring stable and very hot weather in many areas.

In response to a changing pattern, a very strong warm advection will spread from the south into central and northern Europe. It will bring a stable, around a week-long period of very warm to hot days.

Wildfires

Wildfires are increasing in frequency and severity and preparing for them on an annual basis is a new experience for most farmers.

Farmers and farmworkers are at a greater risk for exposure and may come into more frequent contact with wildfire ash and chemical residue due to their work outdoors and long shifts, both during an active fire and as well as during cleanup and recovery. Lost workdays can affect workers economically as well. Regardless of their proximity to wildfires, agricultural workers can struggle with stress and other mental health issues related to the effects of wildfires.

WCAHS is working with agricultural stakeholders to conduct research on the impact of wildfires on the safety and health of agricultural workers. Our research with farmers and farmworkers in the Imperial, Central, and Salinas valleys address farmers’ perceptions of the risks to their workforce and farmworkers’ perceptions of personal risk.