A new regulation of the EU Council, published in early March in the official Journal of the European Union, prohibits importing wood, wood products, as well as charcoal from Belarus into the EU countries. However, the sanctions do not apply to contracts, signed before March 2, 2022, and with a deadline of June 4.

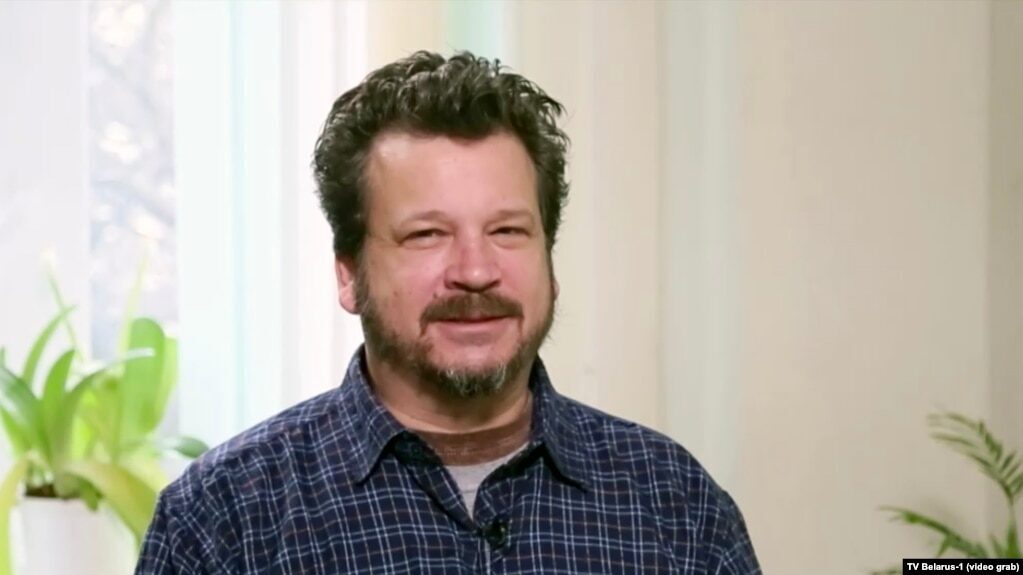

Nevertheless, Alexander Lukashenko said during a meeting with officials to discuss the development of forestry that "no matter what sanctions are imposed against us, there is not enough wood in the world. We'll make it by hook or by crook. It will be asked for, bought. The European Union, our southern states and neighbours will buy it. Vice Premier Yuri Nazarov, in his turn, regarded the sanction pressure as "extremely unpleasant" and stated the need to restructure commodity flows for the delivery of timber abroad.

The decision is, of course, logically the right one. However, its implementation will take time and most likely require additional costs.

Supply of timber to the world market

To understand what financial losses may be incurred by Belarus in the near future, it would suffice to have a look at the official statistics.

According to Belstat, Belarus has significantly increased its timber exports over the past few years, including to the European Union. In 2018, total timber exports amounted to 235.7 thousand cubic meters, in 2019 - 591.6 thousand cubic meters, in 2020 - 924.3 thousand cubic meters.

In value terms, export dynamics have been positive for more than two decades, since not only the volume of supplies increased, but also the global prices of the products. For instance, foreign exchange earnings from exports of the commodity item "wood and wood-based products, charcoal" amounted to: in 2010 - USD 419.4 million, in 2015 - USD 695.4 million, in 2020 - USD 1506.9 million,

and $2,330.0 million in 2021.

In 2020, timber and pulp and paper products in the commodity exports structure of Belarus amounted to 6.3%.

Deliveries to the EU

In recent years, the EU countries actively imported timber and wood products from Belarus. Especially such states as Belgium, the Netherlands, Lithuania, Latvia, Germany, Italy, and Poland.

The dynamics of foreign exchange earnings over the last three years for the main commodity items (TN VED codes) shows strong growth.

Belarus earned $1.14 billion on exports of five commodity items in 2021 alone. But there are other types of products - charcoal, wood chips, sawdust, and pellets. Total exports of wood, wood products and charcoal to the EU amounted to about $1.4 billion.

Revocation of certificates

Another problem faced by the Belarusian timber industry is the revocation of international "forest" certificates.

Two major international bodies certify forests and companies that process and sell forest products: PEFC (Programme for the Endorsement of Forest Certification) and FSC (Forest Stewardship Council).

For companies, having a 'forest certificate' increases their access to markets in developed countries. The certification guarantees the quality and safety of the products. By being PEFC/FSC certified, a company increases the competitiveness of their products on foreign markets and has the opportunity to make more profit.

On the fourth of March, the PEFC Board decided that all timber originating from Russia and Belarus is 'conflict' timber and therefore cannot be used in PEFC certified products. And already on March 8, the FSC Board of Directors suspended all trade certificates issued in Belarus and Russia. This measure will be effective from April 8 this year. The consequences will not be pleasant: Now, Belarusian and Russian timber products and timber cannot be sold or used in products as FSC-certified.

What will the outcome be?

Already in the near future, the timber industry in Belarus will face serious problems. And financial losses are unlikely to be avoided. A negative scenario could result in some companies closing down or stopping operations and reducing production. To avoid this, the best option may be the reorientation of the commodity flow and the search for new markets to reduce losses.

This is exactly what Yuri Nazarov, Deputy Prime Minister of Belarus, was talking about: "Europe has always been a more marginal market. But at the same time China will also buy our products, as well as countries like Azerbaijan, Central Asian countries where timber is not available, and Iran. We just have to calmly reorient what Europe will not take and make money from it.

Thus, exports to the EU fall away because of sanctions. All attempts at illegal imports are likely to fail. Europe has promised to tighten controls at borders and closely monitor import/export.

Some of the products could be taken by Russia, but there are enough problems there as it is. Plus Russian companies have also lost their PEFC/FSC certificates, and this complicates sales. It is quite possible that the Russian government will support domestic producers and reduce timber imports from Belarus.

If we consider expanding exports to the PRC, the main problem here is logistics. Danish company Maersk, which specialises in marine cargo transportation, has suspended taking orders for shipments to and from Belarus. Certainly, it is possible to do without sea containers and use railway, in particular, the New Silk Way but even here things do not go smoothly.

Given the "potash crisis", it is quite possible that some fertilisers may go to the Celestial Empire by rail (if the potash contract with the PRC is signed). Potash is more important than timber, so wagons and platforms for it will be given away. Besides, not every Chinese company will agree to buy timber that does not have an international certificate. And if it does, it may demand a below-market price.

Azerbaijan, which Nazarov mentioned as an alternative to the European market, may also face problems. Here they would have to compete for the market with the Russian Federation and Turkey. And in the Central Asian markets, Russia's share is also large.

Translated with

www.DeepL.com/Translator (free version)