Michael B-C

The Living Force

Perhaps the CEOs are just seeing the writing on the wall. Didn't one of the sessions discuss that the global Ponzi scheme could not go on forever? And although to most, these CEOs may appear to be top dogs, in reality, they are probably not part of the 20 powerful people who are controlling 42% of the planet (Barrie Trower @ 9:02 in vid below).

Corrupt stock buy backs have been endemic throughout the corporate system for years now funded by access to hyper-cheap or effectively free money from the central banks (a financial commentator recently called the Federal Reserve out as nothing but a rogue hedge-fund in hiding). The current generation of CEOs are asset strippers who have been given/taken the green light to act solely in personal interest by the unspoken systemic corruption and greed that is the only game in town when it comes to corporations, banks etc. The past year has seen a huge sell off of these share-options - bought for cents and realized for billions - and are now nothing but rats leaving a sinking ship that they themselves chewed holes in. They didn't need to be connected to the top of the ponzi-scheme pile to know/see the writing on the wall - they were in a privileged position to know the effect their actions had on their own balance sheet - a black hole of debt with no real assets left. They created a Titanic and then hopped ship as the icebreaker hove into view.

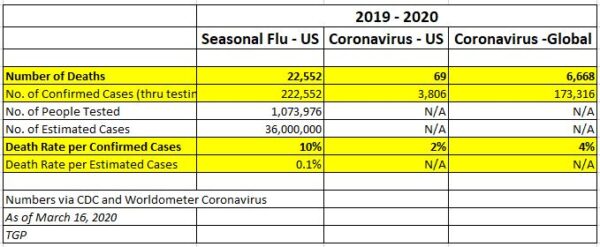

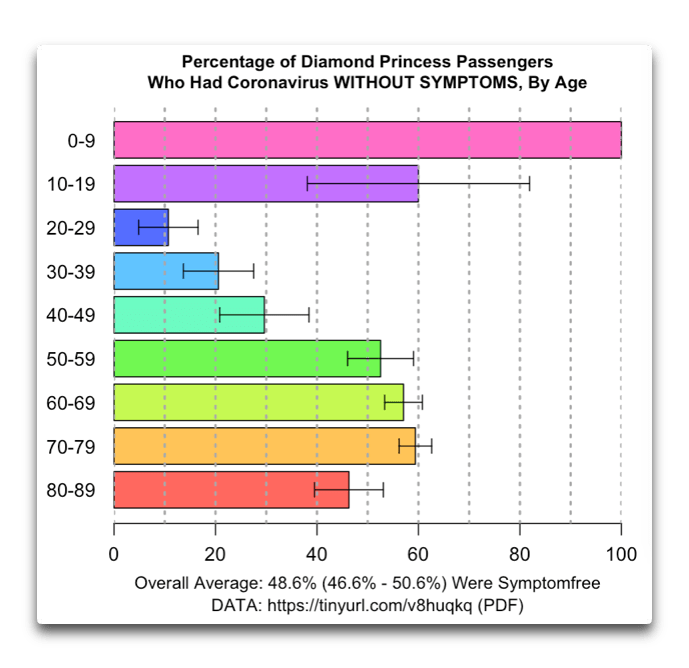

Don't think there's anything false flag about any of it, apart from hyping a relatively normal virus beyond all reason. You should stop for a moment and try to think things through clearly. There is a new coronavirus. Objectively, it's no more significant than the flu, but governments have decided, for some reason, to activate their "crisis planning" for it. Forget about the virus and what the media is saying about it, it's mostly nonsense, and wonder what the government is getting, or thinks its getting, out of locking down populations.

I don't disagree Joe. However the Why Italy issue does have some interesting strategic financial undertones. $4 trillion in debt and the worst GDP in the world for past 18 years. The country is effectively bankrupt. The micro and the macro. At another level the situation in Italy could thus equate to the same stress testing that is going on with minor/vulnerable banks and corporations - as such Italy is the next massively vulnerable European economy fit for rape and pillage as well as being a possible US type attack on the continent's underbelly (via terms in the coming bale-out the EU/World bank will have to make/force on Rome) in an effort to bring us into line with US policy on Iran, not buying energy from Russia, etc. Punishment for not towing the line. Also plenty of assets in Italy waiting a forced sell off...

Maybe his big plan is to force as many people as possible into the next thing:

We offer you a Universal Basic Income so that you can survive, but in exchange you must receive the universal vaccine (Agenda ID2020) otherwise it will not be granted.

Even if it were not true, perhaps it would be good to start launching this idea in social networks as a way to go ahead and discourage its implementation?

Yes, I think this is very much in play Javi. Here in Ireland the service sector - pubs, hotels, restaurants, cultural services, small shops - will be utterly devastated by this. Once closed for any length of time, reopening will become next to impossible. 50,000 workers already laid off in pubs... on Paddy's Day! Unheard of. I would say at least 20% of the workforce here are now facing certain medium to long term unemployment in the coming months and that figure is going to only rise each day this goes on. The fund my theatre launched (making national news) has just reached €20,000 in donations in 3 days (amazing) but we opened the application process this morning and we have already had 300 applications worth €100,00 in requests... a microcosm of the coming hardship that will play its part in forcing folk to accept whatever terms the government makes for the scale of social welfare required to put a swab on the problem. Problem, Reaction, Solution.

Coronavirus: ‘The people involved in this business are so vulnerable’