I found the following article on Cointelegraph quite interesting:

The Bank for International Settlements looks at the role of central bank digital currencies in financial inclusion around the world.

cointelegraph.com

Cointelegraph said:

The Bank for International Settlements, or BIS, released a paper Tuesday on central bank digital currencies, or CBDCs, and

how they can be used to meet policy goals for financial inclusion. The paper

drew on interviews conducted in the second half of last year at nine central banks that are currently exploring retail CBDCs. It looked at common goals across a range of economic development levels and challenges to inclusion.

The paper identified two distinct approaches to CBDC. Some central banks saw digital currency as a catalyst for innovation and development while others expected it to

serve as a complement to existing initiatives. All of the central banks emphasized the need for stakeholder education and acceptance, both among consumers and service providers.

For those who need a translation, "

financial inclusion" is a feel-good paramoralism shaped by central bankers that means the assimilation of every man, woman and child into a system of economic management that gives the bankers ultimate control over what happens, or doesn't happen, to every unit of currency within that system.

"

Existing initiatives" are the monetary policy tools such as fractional reserve banking and quantitative easing that the bankers have been using to pillage value from the real economy - the productive output of human beings - for centuries.

Cointelegraph said:

Data privacy, and the related issues of money laundering and the financing of terrorism, were seen as top challenges. Servicing the vulnerable — children, the elderly and users with disabilities — was also named a priority.

Here, reading between the lines, we see the points of primary concern for them that CBDCs are meant to address.

1.

Data privacy - the ability to hide a transaction from the eyes of the central bankers is their main concern. Thus we can assume CBDCs to have total financial surveillance capability as a design goal.

2.

Money laundering and the financing of terrorism - since vast quantities of money laundering and terrorist financing take place within the legacy financial system as numerous reported scandals by HSBC, various European banks et al over the last decade or so demonstrate, we can be reasonably certain that stopping these activities is not intended, merely providing the capability to do so for arbitrary political reasons. Canada's Trudeau gave us an unintended preview of what kinds of situations would be rationalized as 'appropriate' with the freezing of accounts related to the financing of the Canadian Trucker's protest earlier this year. Thus, blocking of transaction capability and suspension and rerouting of funds without the owner's consent are also likely "must have" design goals for CBDCs.

3.

Servicing the vulnerable - these groups are typically seen as those that most "require" government assistance, justifying taxation of the non-"vulnerable" in order to pay for said assistance. Thus, we can assume that social welfare features will be design goals of CBDCs as well - the ability to distribute government payments such as UBIs, restrict funds to certain types of transactions (eg. virtual food stamps), provide for automatic taxation of certain types of payments (salaries, luxury purchases) and garnishing of others (eg. child support payments).

Cointelegraph said:

Some challenges, such as geographical isolation and levels of digitization, varied in degree among the central banks, but several CBDC design features were highlighted as key to financial inclusion across the spectrum. Promotion of a two-tiered payment system with private-sector participants, interoperability across a multiple functions and borders, and adequate regulation were elements mentioned in this context.

Here, "

two-tiered payment system" refers to a Central or Reserve Bank that is nominally controlled by a national government on one tier, and another for private banks that would have a privileged position compared to typical retail participants. In the current US system, these banks are those that borrow currency from the Federal Reserve at zero or near-zero interest and lend it out at much higher rates, making profit at virtually no cost.

"

Interoperability across multiple functions and borders" means the system will work the same way regardless of whether it is operated by private institutions or government, regardless of what the system is being requested to do (tax funds, suspend funds, transfer funds etc.) and regardless of what country the system operates in.

"

Adequate regulation" means adequate deployment of government force to ensure that people use the system and aren't able to opt out.

Note that many of these design goals are already present and functional in the existing financial system - there's no real need for CBDCs, as it were.

Cointelegraph said:

The central banks discussed in the paper were those of

The Bahamas, Canada, China, the Eastern Caribbean, Ghana, Malaysia, the Philippines,

Ukraine and Uruguay. The

World Bank also took part in the research.

The BIS has taken a

strong stance on the place of the central bank in the emerging digital economy and

the need for cryptocurrency regulation. It recently

completed a successful pilot project, called

Project Dunbar, with the central banks of Australia, Malaysia, Singapore and South Africa to create an international settlements platform.

So, we can expect more crypto regulation in the very near future. And this seems to be the main point. Governments, especially western governments,

do not want a situation where people have the ability to create their own sovereign currencies at will and avoid political control via the economy. In a certain sense, this is reasonable, because a nation with different currencies constantly being created by the populace tends toward an increased level of economic chaos. On the other hand, if there's no specific economic advantage to creating a competing currency because the most popular currency is sound money, the problem tends to take care of itself. So it's only because of national governments defrauding their own populations with economic trickery that this is even a problem in the first place.

What does this mean for the biggest cryptocurrencies? It means that any effective level of decentralisation can only exist between national governments which have the military capabilities to assert their own sovereignty. Thus, unless we have multiple countries willing to use a cryptocurrency in international trade or allow it as legal tender for their own citizens, it's likely that regulation will increasingly lead to either a) capital flight from crypto or b) capital migration into only those projects allowed to exist as a speculative asset class, making the crypto market not much more than another derivatives market. In either case, we're likely looking at a massive revaluation of the crypto market as regulation increases in stages. Some coins may survive; the vast majority are likely to go to zero.

However, Russia is the wildcard. China has already declared its position by banning crypto. But if Russia were to allow energy trading in Bitcoin, and actively work towards a federation of countries that endorse Bitcoin as an accepted international trade currency, it could change everything. Bitcoin is not perfect. There are likely all kinds of technical issues with the protocol that still need to be worked out. But with enough sovereign credibility, Russia could turn the tables on Bitcoin as a psyop and cause a MASSIVE capital flight from USD into Bitcoin as USD hyperinflation kicks in and Bitcoin is seen as a safe haven, preserving trillions of rubles of wealth for people all around the globe.

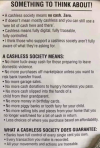

Something to think about, yes?