It's happened before!I don't have the technical details figured out yet, but from the general idea of blockchain as it relates to bitcoin, it seems to me that the robustness of the system is based upon the assumption that all the computers in the network have computing power to the same magnitude, so that a single node couldn't compete against the whole network on the long run. I saw somewhere that a certain "guild of bitcoin miners" introduced a chain of 6 blocks (don't know if they were fraudulent transactions or not). My understanding is that at any point in time, the longuest cryptographically verfiable block chain at any point in time wins the race so to speak.

Now if a government/military whatever organization have computing capabilities that excede by orders of magnitude the computing capabilities of super computer werehouses with their GPUs and TPUs, maybe through quantum computing or some undisclosed technology, they would be able to rig the game without being noticed or traceable. I could be mistaken though.

Russian nuclear scientists detained for 'Bitcoin mining plot'

Russian security officers have arrested several scientists working at a top-secret Russian nuclear warhead facility for allegedly mining crypto-currencies. The suspects had tried to use one of Russia's most powerful supercomputers to mine...

Russian nuclear engineers busted for using supercomputer to mine cryptocurrencies

A powerful supercomputer located at a Russian nuclear research facility in Sarov was reportedly targeted by a pair of engineers who wanted to use it to mine cryptocurrencies. "There has been an attempt of unsanctioned use of workplace computing...

Russian metals plant to start bitcoin mining

A Russian aluminum plant closed as a result of U.S. sanctions is set to be transformed into a bitcoin mining hub. The Nadvoitsy Aluminum Plant in Russia's northern Karelia region, owned by Russian metals giant Rusal, stopped production last...

Now imagine who isn't getting caught?

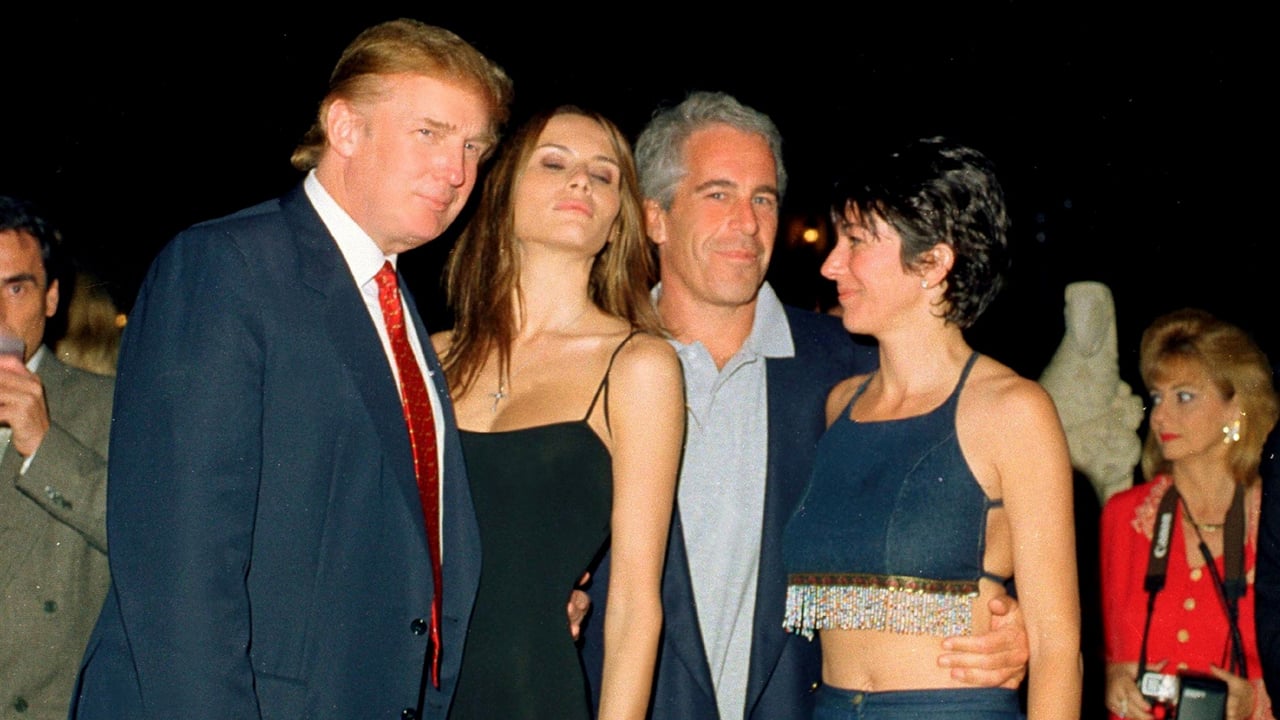

Jeffrey Epstein Confidant Ghislaine Maxwell's Rumored Last Reddit Post Was About Bitcoin

It seems the last time Ghislaine Maxwell used Reddit, her last post was about someone mysteriously sending a billion in bitcoin on June 30.