Incredible, makes me think that the US really is that city upon a hill! I'm getting Caesar vibes from this too.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump era: Fascist dawn, or road to liberation?

- Thread starter Cosmos

- Start date

Hmm, about a third of the way down the article, there is this sub-heading... the title of this thread.

Fascist Dawn, or Road to Liberation?

While the media in Canada is surprised by the number of Trump flags, it does not surprise any of the demonstrators. The media characterizes the rally as a protest against wearing masks. But if you speak with any of the demonstrators, their reasoning extends far beyond a simple face mask rule. To them, it’s a freedom (Liberté) movement.

They view Trump as someone that represents freedom for the people and national sovereignty for their country. The demonstrators love Canada. To them, Trump represents the idea Canadians should self-determine their destiny. These demonstrators want political policies that make sense for Canadians. This means NO MORE BULLSHIT handed down to them from a global elite.

One rally goer explained her Trump support: “Trump epitomizes the revolt against globalism. People must run their affairs, not politicians. If America falls to the globalists, it’s easier for the rest of the world to follow.”

Other rally goers in Montreal echoed similar reasoning: “Globalist use climate change and now this pandemic to gain control. They can’t control Trump. They hate him because they can’t control him.”

[...]

Fascist Dawn, or Road to Liberation?

While the media in Canada is surprised by the number of Trump flags, it does not surprise any of the demonstrators. The media characterizes the rally as a protest against wearing masks. But if you speak with any of the demonstrators, their reasoning extends far beyond a simple face mask rule. To them, it’s a freedom (Liberté) movement.

They view Trump as someone that represents freedom for the people and national sovereignty for their country. The demonstrators love Canada. To them, Trump represents the idea Canadians should self-determine their destiny. These demonstrators want political policies that make sense for Canadians. This means NO MORE BULLSHIT handed down to them from a global elite.

One rally goer explained her Trump support: “Trump epitomizes the revolt against globalism. People must run their affairs, not politicians. If America falls to the globalists, it’s easier for the rest of the world to follow.”

Other rally goers in Montreal echoed similar reasoning: “Globalist use climate change and now this pandemic to gain control. They can’t control Trump. They hate him because they can’t control him.”

[...]

lilies

The Living Force

Trump announces creation of national '1776 Commission' to promote 'patriotic education'

Something tells me this is groundbreaking. Will effect changes that aim to counteract the "democrat-caused wrecking of the chessboard in process" and that we are suddenly on a new timeline again.

Something tells me this is groundbreaking. Will effect changes that aim to counteract the "democrat-caused wrecking of the chessboard in process" and that we are suddenly on a new timeline again.

BOOM! The report also connects Biden with prostitution and human trafficking.

www.thegatewaypundit.com

www.thegatewaypundit.com

September 23, 2020

BREAKING: Senate Finance and Homeland Security Committees Release DEVASTATING Report on Hunter Biden, Burisma and Corruption — CROOKED BIDEN FAMILY ENRICHED THEMSELVES AND OBAMA KNEW!

Full report: https://www.hsgac.senate.gov/imo/media/doc/Ukraine Report_FINAL.pdf

BREAKING: Senate Finance and Homeland Security Committees Release DEVASTATING Report on Hunter Biden, Burisma and Corruption -- CROOKED BIDEN FAMILY ENRICHED THEMSELVES AND OBAMA KNEW! | The Gateway Pundit | by Jim Hoft

In March Senator Ron Johnson told reporters that Senate Republicans are entering a new phase of their investigation into Joe and Hunter Biden and their ties to a corrupt Ukrainian natural gas company, Burisma.

September 23, 2020

BREAKING: Senate Finance and Homeland Security Committees Release DEVASTATING Report on Hunter Biden, Burisma and Corruption — CROOKED BIDEN FAMILY ENRICHED THEMSELVES AND OBAMA KNEW!

Full report: https://www.hsgac.senate.gov/imo/media/doc/Ukraine Report_FINAL.pdf

Just opened the online Columbus Dispatch news site - top headlines:BOOM! The report also connects Biden with prostitution and human trafficking.

Trump remarks draw ire of some in US, Ohio GOP

Biden looks to reverse Trump's 2016 win in Ohio

Zero mention of the " DEVASTATING Report on Hunter Biden, Burisma and Corruption " or anything relating to Hunter Biden using the search function.

Hard to believe no one at the Dispatch picked up on this - it's right up their very hard-left news alley:

Scoopyweb giving Babylon Bee a run for the money!Democrats Say Hunter Biden’s Massive Scandal Is Nowhere Near As Bad As That Time Trump Did Nothing Wrong *

The media and other Democrats say reports of Hunter Biden’s massive corruption are nowhere near as bad as that time Donald Trump did nothing wrong.

The charges against Hunter were detailed in a congressional report which was issued in the form of a poster-size photograph of Hunter under the words, “Have you seen this man?”

The report says Hunter received a $3.5 million wire transfer from Elena Baturina, a Russian who became rich after receiving lucrative contracts from the city of Moscow, where her husband was mayor.

Democrats say there’s nothing to see here because it was the sort of payment anyone might receive from a deeply corrupt Russian businesswoman in return for absolutely nothing.

The report also says Hunter paid large amounts of money to what “appears to be an Eastern European prostitution or human trafficking ring.”

But Democrats say there’s nothing to see here because Hunter probably needed a massage after carrying around all that heavy money from Elena Baturina.

The report says further that Hunter made more millions as a consultant to the energy company Burisma even though he had no expertise in the field.

But Democrats say there’s nothing to see here because they’ve ripped out their eyeballs and set them on fire so there’s literally nothing they can see.

Even officials within the Obama administration were concerned that Hunter’s behavior while his father was Vice President might have created the impression that the Bidens were running a corrupt scam out of the White House, but Democrats say there’s nothing to see here because skiddleewink shaban do-do kragnatz.

Reporters immediately gathered around Joe Biden’s basement to ask the candidate such tough questions as “What does it say about Donald Trump’s soul, that after killing thousands of people by giving them coronavirus, he has the gall to accuse your beloved son of some sort of wrongdoing just because he made millions off corrupt Russian and Ukranian officials while you were VP?”

Biden responded, “Come on, man. Here’s the deal,” and Democrats say that clears up everything.

* [Satire]

Democrats Say Hunter Biden’s Massive Scandal Is Nowhere Near As Bad As That Time Trump Did Nothing Wrong [Satire]

The Columbus Dispatch did have the Biden story by the AP in today's paper, but still doesn't show up on their website:

More and more people only access the Dispatch online, so they would have to learn of this news through another source unless they read the E-edition that presents a digital hard copy of the paper. Didn't make the front page - rather page A4.

At least the entire article was printed rather than only partially which is often the case.

apnews.com

apnews.com

And if one reads the AP article, it downplays the Bidens or the Obama administration of doing anything wrong at all other than to say Hunter's position with Burisma was "very awkward" and "problematic". Now there's a damning allegation! In fact, the last paragraph of the article derides the Trump federal response to the pandemic. The two key takeaways from this article:

"There is no evidence of wrongdoing by the Bidens, and Hunter Biden has denied using his influence with his father to aid Burisma."

“As the coronavirus death toll climbs and Wisconsinites struggle with joblessness, Ron Johnson has wasted months diverting the Senate Homeland Security & Governmental Affairs Committee away from any oversight of the catastrophically botched federal response to the pandemic, a threat Sen. Johnson has dismissed by saying that ‘death is an unavoidable part of life,’” Biden campaign spokesperson Andrew Bates said in a statement.

No, this article is a complete whitewash - nothing to see here folks; move along.

More and more people only access the Dispatch online, so they would have to learn of this news through another source unless they read the E-edition that presents a digital hard copy of the paper. Didn't make the front page - rather page A4.

At least the entire article was printed rather than only partially which is often the case.

GOP Senate report on Biden son alleges conflict of interest

Two Republican-led Senate committees have issued a politically charged report alleging that the work Joe Biden’s son did in Ukraine constituted a conflict of interest for the Obama administration at a time when Biden was engaged in Ukraine policy as vice president.

And if one reads the AP article, it downplays the Bidens or the Obama administration of doing anything wrong at all other than to say Hunter's position with Burisma was "very awkward" and "problematic". Now there's a damning allegation! In fact, the last paragraph of the article derides the Trump federal response to the pandemic. The two key takeaways from this article:

"There is no evidence of wrongdoing by the Bidens, and Hunter Biden has denied using his influence with his father to aid Burisma."

“As the coronavirus death toll climbs and Wisconsinites struggle with joblessness, Ron Johnson has wasted months diverting the Senate Homeland Security & Governmental Affairs Committee away from any oversight of the catastrophically botched federal response to the pandemic, a threat Sen. Johnson has dismissed by saying that ‘death is an unavoidable part of life,’” Biden campaign spokesperson Andrew Bates said in a statement.

No, this article is a complete whitewash - nothing to see here folks; move along.

Looking for confirmation on the first tweet! The heads, they be-a Roll-in.

www.zerohedge.com

Tyler Durden by Tyler Durden Wed, 10/07/2020 - 09:35 (All emphasis ZH) 6-8 minute Read:

www.zerohedge.com

Tyler Durden by Tyler Durden Wed, 10/07/2020 - 09:35 (All emphasis ZH) 6-8 minute Read:

The stakes couldn’t be much higher for Mike Pence heading into his first and only face-off with Kamala Harris as the Biden-Harris ticket continues to expand their lead in the national polls.

After the Trump-Biden dumpster-fire - with both candidates and the moderator repeatedly interrupting one another - tonight’s debate between Mike Pence and Kamala Harris is far less likely to devolve into cacophony.

Instead, it seems more likely Pence will highlight two extremely unflattering aspects of Kamala Harris: her prickliness and her radicalism.

And, as RealClearPolitics' Susan Crabtree notes Harris will focus on attacking the vice president’s nice-guy reputation, pointing to Pence’s previous opposition to same-sex marriage and related issues impacting the LGBTQ Americans. The issue of LGBTQ rights could come up after Supreme Court Justices Clarence Thomas and Samuel Alito issued a broadside against the high court’s same-sex marriage decision on Monday when the court declined to hear a case brought by a former Kentucky county clerk who refused to issue a marriage license for same-sex couples.

By now, Pence is used to playing good cop to Trump’s bad one. As a former radio talk show host, he knows how to serve up disciplined sound bites aimed at a target audience. But, as RealClearPolitics' Susan Crabtree notes, no one expects Harris to make it easy for him or to pull her punches after her record of fierce attacks against Biden and other opponents in the Democratic primary debates.

And so, in tonight's debate, as AmericanThinker.com's Chad Banghart details, Vice President Mike Pence has a golden opportunity. With the COVID-19 pandemic refusing to go away, President Trump's right-hand man can prove that a Republican administration is the right one for the job at hand.

This is especially true in light of the first presidential debate, which split American voters along party lines. Democrats predictably praised Joe Biden's performance, while Republicans saw President Trump as the clear victor. Independents were left uninspired by a debate marred by mumbling; interrupting; and poor, often biased moderating.

This brings us back to Mike Pence. With Biden polling favorably in recent weeks, President Trump will look for his running mate to steady the ship and bring more of the required fight. Here's how to do it:

Continued:

That's a BOOM for Putin.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The stakes couldn’t be much higher for Mike Pence heading into his first and only face-off with Kamala Harris as the Biden-Harris ticket continues to expand their lead in the national polls.

After the Trump-Biden dumpster-fire - with both candidates and the moderator repeatedly interrupting one another - tonight’s debate between Mike Pence and Kamala Harris is far less likely to devolve into cacophony.

Instead, it seems more likely Pence will highlight two extremely unflattering aspects of Kamala Harris: her prickliness and her radicalism.

And, as RealClearPolitics' Susan Crabtree notes Harris will focus on attacking the vice president’s nice-guy reputation, pointing to Pence’s previous opposition to same-sex marriage and related issues impacting the LGBTQ Americans. The issue of LGBTQ rights could come up after Supreme Court Justices Clarence Thomas and Samuel Alito issued a broadside against the high court’s same-sex marriage decision on Monday when the court declined to hear a case brought by a former Kentucky county clerk who refused to issue a marriage license for same-sex couples.

By now, Pence is used to playing good cop to Trump’s bad one. As a former radio talk show host, he knows how to serve up disciplined sound bites aimed at a target audience. But, as RealClearPolitics' Susan Crabtree notes, no one expects Harris to make it easy for him or to pull her punches after her record of fierce attacks against Biden and other opponents in the Democratic primary debates.

And so, in tonight's debate, as AmericanThinker.com's Chad Banghart details, Vice President Mike Pence has a golden opportunity. With the COVID-19 pandemic refusing to go away, President Trump's right-hand man can prove that a Republican administration is the right one for the job at hand.

This is especially true in light of the first presidential debate, which split American voters along party lines. Democrats predictably praised Joe Biden's performance, while Republicans saw President Trump as the clear victor. Independents were left uninspired by a debate marred by mumbling; interrupting; and poor, often biased moderating.

This brings us back to Mike Pence. With Biden polling favorably in recent weeks, President Trump will look for his running mate to steady the ship and bring more of the required fight. Here's how to do it:

Continued:

That's a BOOM for Putin.

Yesterday a special report issued by the FBI stated they would make an announcement about security. It was speculated this could be Wray's resignation but no it's this. Something I think is interesting about this is, when has the FBI ever given a report like this to the citizens? It's likely happened in the past at some time but right now its something new it seems. Maybe this is something that will occur on a more frequent bases and will continue after a Trump reelection as part of a new system. The election is only 28 days away and things will become intense and bizarre is my guess. There's a lot of speculation going on right now since the times are so exceptional.

www.thegatewaypundit.com

www.thegatewaypundit.com

FBI, DOJ 11 AM Press Conference: FBI and DOJ Announce Charges Against ISIS ‘Beatles’ Who Admitted to Abusing US Hostages – No Death Penalty

FBI, DOJ 11 AM Press Conference: FBI and DOJ Announce Charges Against ISIS 'Beatles' Who Admitted to Abusing US Hostages - No Death Penalty | The Gateway Pundit | by Jim Hoft

The Department of Justice announced Tuesday they were holding a virtual press conference Wednesday morning on a matter of national security.

So, the story goes that Trump has been quietly replacing a great many corrupt federal judges. Then I saw this today... Maybe there's hope!

(from Zero Hedge)

A federal appeals court has reinstated a fraud conviction of Hunter Biden's longtime business partner, Devon Archer, reversing a decision by an Obama-appointed judge (and wife of Mueller special counsel lawyer) to vacate Archer's conviction and grant him a new trial.

Devon Archer (far left) is pictured with Joe and Hunter Biden. (Screenshot from Twitter)

Devon Archer (far left) is pictured with Joe and Hunter Biden. (Screenshot from Twitter)

Archer and several of his business partners were indicted on March 26, 2018 in a $60 million bond scheme which defrauded Native Americans. Hunter was not implicated in the fraud, however Archer and the other partners repeatedly name-dropped the former Vice President's son.

(from Zero Hedge)

A federal appeals court has reinstated a fraud conviction of Hunter Biden's longtime business partner, Devon Archer, reversing a decision by an Obama-appointed judge (and wife of Mueller special counsel lawyer) to vacate Archer's conviction and grant him a new trial.

Devon Archer (far left) is pictured with Joe and Hunter Biden. (Screenshot from Twitter)

Devon Archer (far left) is pictured with Joe and Hunter Biden. (Screenshot from Twitter)Archer and several of his business partners were indicted on March 26, 2018 in a $60 million bond scheme which defrauded Native Americans. Hunter was not implicated in the fraud, however Archer and the other partners repeatedly name-dropped the former Vice President's son.

Two bold moves by Trump, behind the scene's.

gcaptain.com

gcaptain.com

If one is not familiar with accorded, John Stossel gives a reasonable explanation, of who it favors.

Meanwhile the opposition goes on the rampage drifting to the elections.

U.S. Has Officially Left Paris Climate Agreement | KQED (Fear Pron)

Snip:4-6 minute Read

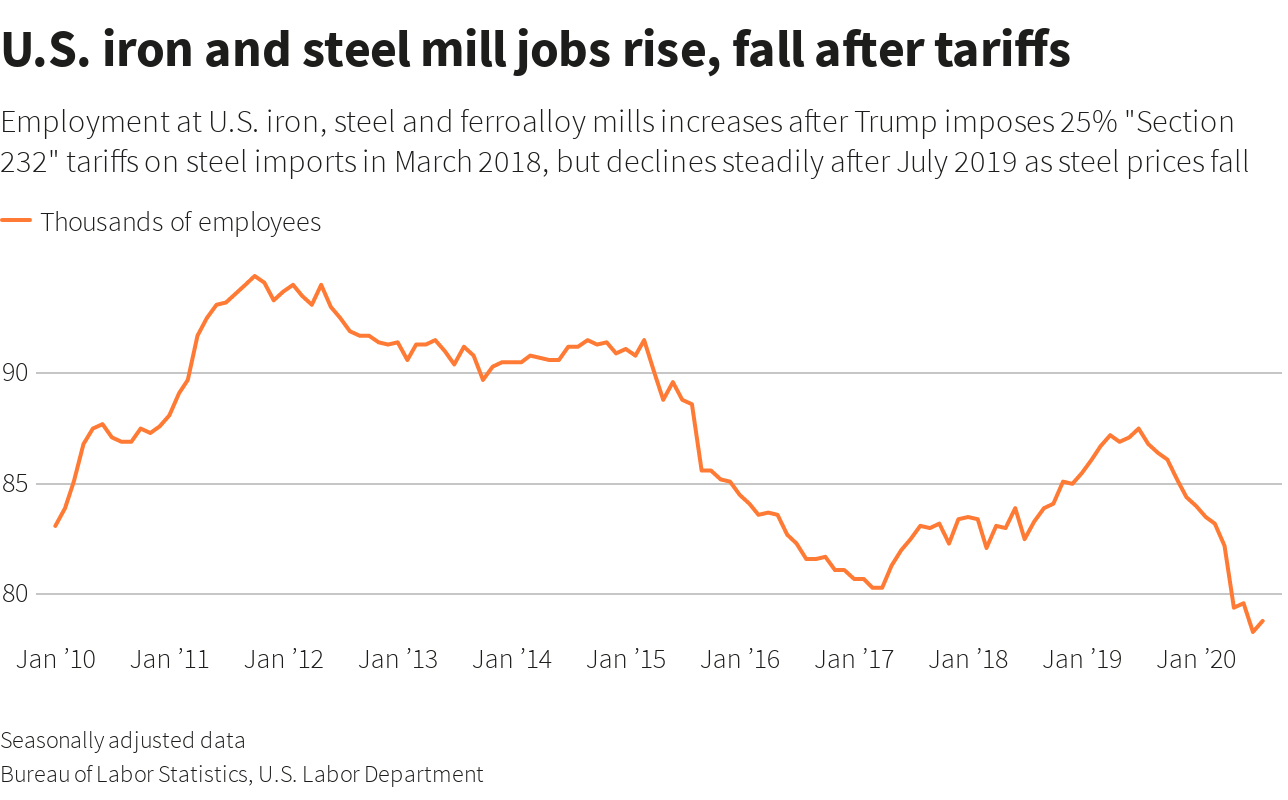

Trump Changed How the U.S. Trades, But Not Necessarily as Intended - Graphs

WASHINGTON, Nov 2 (Reuters) – U.S. President Donald Trump’s “America First” trade policy torched a 70-year consensus on trade liberalization, drew a harder line against China’s state-driven economic model and...

gcaptain.com

gcaptain.com

WASHINGTON, Nov 2 (Reuters) – U.S. President Donald Trump’s “America First” trade policy torched a 70-year consensus on trade liberalization, drew a harder line against China’s state-driven economic model and erected new tariffs on imported steel and aluminum, alienating allies.

Trump is touting his efforts to protect American workers and a Phase 1 trade deal with China that promises to boost U.S. exports as closing arguments in Tuesday’s presidential election.

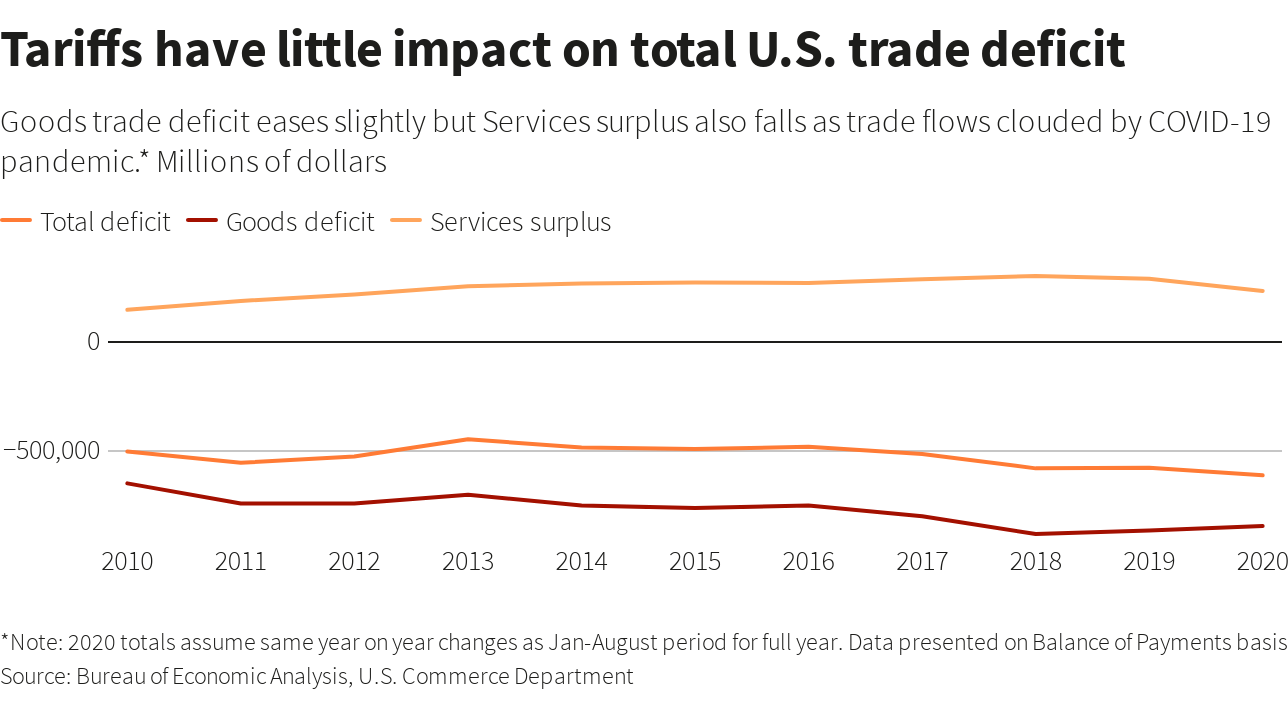

Economic data so far shows mixed results from that effort, with some sectors gaining at the expense of others, but with little change in the overall U.S. trade deficit for goods and services.

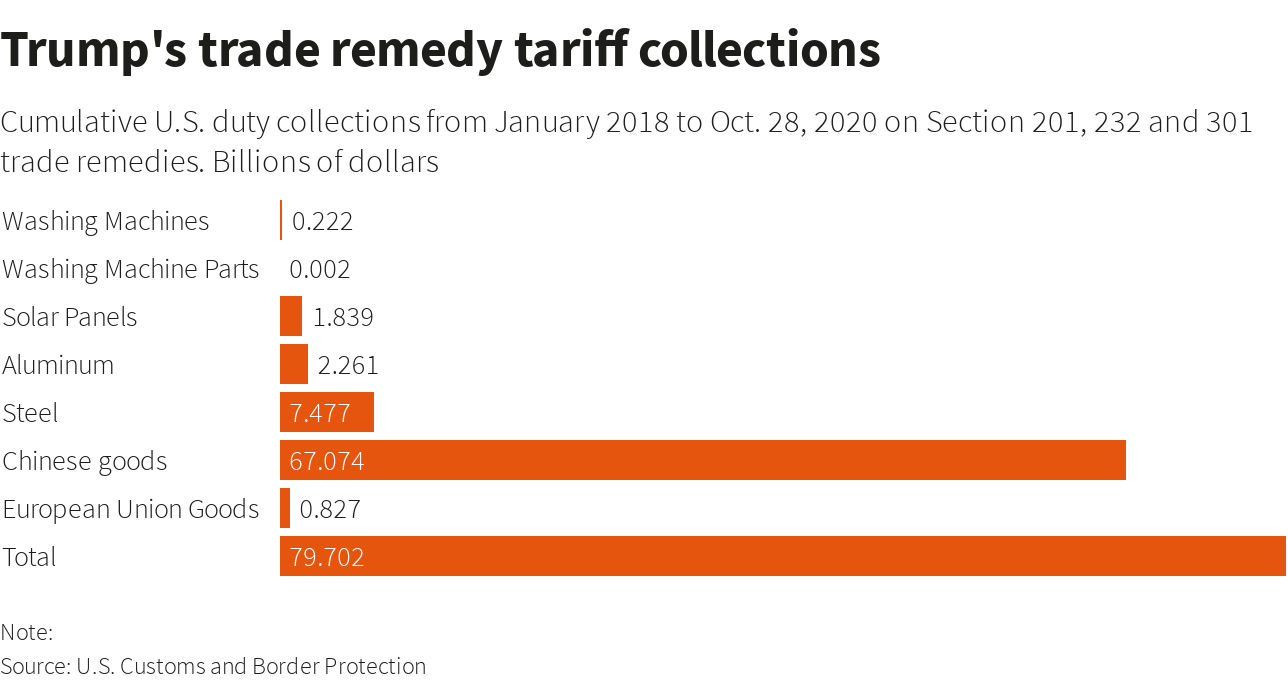

Since 2018, Trump has imposed punitive tariffs on imported washing machines, solar panels, steel, aluminum and goods from China and Europe, with Chinese imports accounting for most of the nearly $80 billion collected so far.

The tariff war against China started with a 2017 investigation into longstanding U.S. complaints about Chinese state-driven economic policies, including intellectual property theft, forced technology transfers and rampant subsidies to state-owned firms that were pushing the U.S. trade deficit higher.

Business interests largely supported the goals of the “Section 301” probe, but warned that tariffs would hurt U.S. competitiveness by raising input costs.

Retaliations and escalations eventually imposed tariffs on $370 billion in Chinese goods before the Phase 1 deal was signed in January, committing Beijing to boost purchases of U.S. farm and manufactured goods, energy and services by $200 billion over two years.

Thus far, the tariffs have reduced imports of goods from China but have not significantly altered the global U.S. goods and services trade deficit.

Companies responded by diversifying supply chains, shifting some production out of China – but mostly to other low-wage countries, such as Vietnam and Mexico, not to the United States.

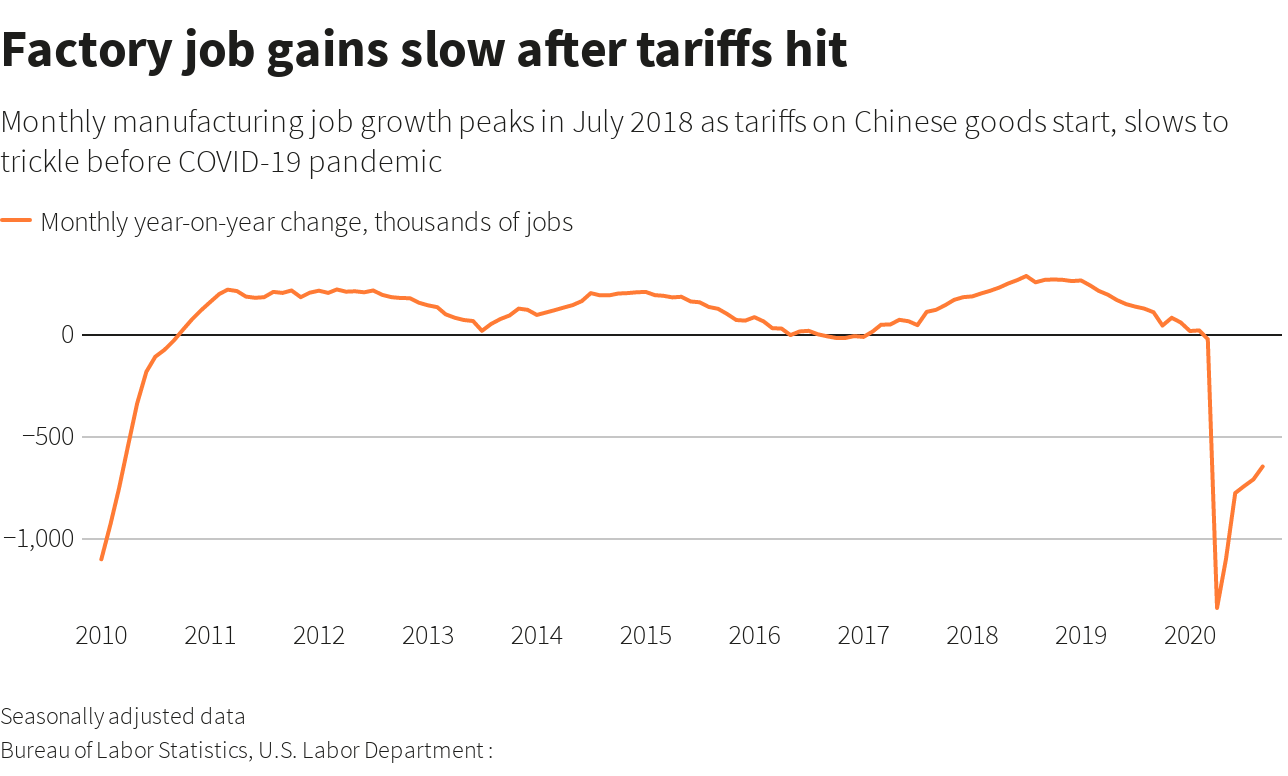

One of Trump’s goals was to increase American manufacturing jobs. The numbers have grown since he took office in 2017, partly due to a massive corporate tax cut. But manufacturing employment growth slowed after he launched the tariffs in 2018, becoming a trickle before the coronavirus pandemic hit in early 2020.

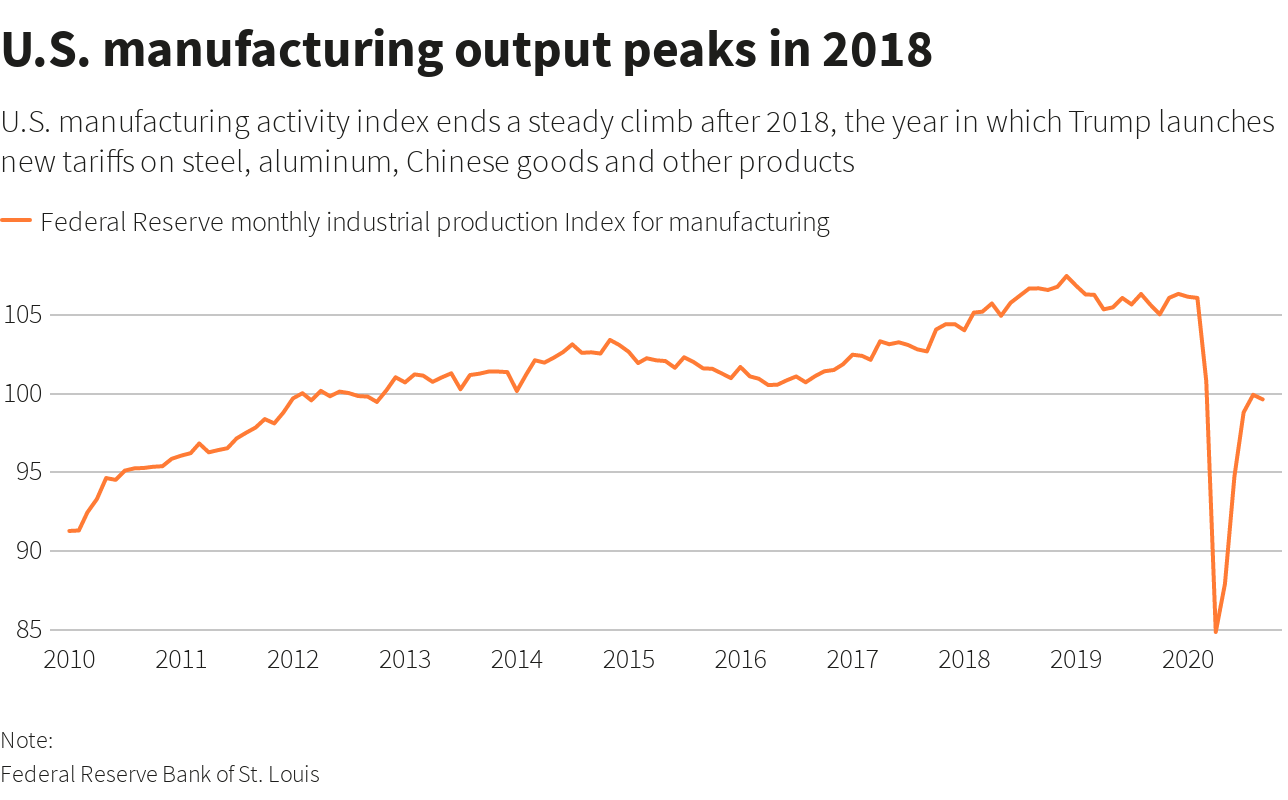

The Federal Reserve’s measure of U.S. manufacturing output also peaked in 2018.

STEEL SLIDE

Trump angered U.S. allies in Europe, Asia and the Americas by imposing 25% tariffs on steel and 10% on aluminum in 2018 on national security grounds.

The tariffs prompted new investment in the sector and restarts of some idled mills, including U.S. Steel Corp’s Granite City Works in Illinois. But the hiring renaissance was short-lived as lower prices caused some closures, including one of two blast furnace at Granite City, where Trump heralded the industry’s renaissance in July 2018.

Steel industry executives have argued that without the tariff protections, domestic steelmakers would be in far worse shape because of a global production glut largely centered in China. The tariffs have cut the market share of imports, allowing domestic steelmakers to utilize more of their capacity.

“NO DISASTERS”

Backers of Trump’s trade strategy argue that it did not lead to the major dislocations predicted by industry and won bigger concessions from China than any previous U.S. president did.

It pushed U.S. companies to diversify away from China and move some critical supply chains to the United States, said Stephen Vaughn, former general counsel at the U.S. Trade Representative’s office.

“All the sorts of disasters that people on the other side predicted literally never happened,” said Vaughn, now a trade partner at the King and Spalding law firm. “Even if you assume that all of the tariffs were paid by consumers, an $80 billion tax increase was never going to tank a $22 trillion economy.”

While Trump’s Phase 1 trade deal is now starting to boost agricultural exports to China after a slow start amid the COVID-19 pandemic, it failed to address many of the issues that really matter to U.S. companies. These include China’s technology transfer policies, industrial subsidies and barriers to digital services access in China.

“There’s still a legitimate question about what all this pain was paying for,” said Nasim Fussell, who served until August as the Republican trade counsel on the U.S. Senate Finance Committee. “There will be pressure from stakeholders to work towards a Phase 2” to address more substantive issues, added Fussell, now a trade lawyer at Holland and Knight.

But China remains barely more than halfway to its first year purchase targets on the Phase 1 trade deal, particularly for manufactured goods during the COVID-19 pandemic, according to trade data calculations by Chad Bown, a senior fellow with the Peterson Institute for International Economics.

Economic factors such as commodity prices, Chinese tariffs, slack demand for air travel and a swine flu epidemic in China are weighing heavily on the export flows, Bown said.

“The dictum of ‘You need to buy more’ doesn’t necessarily seem to work.”

(Reporting by David Lawder; editing by Heather Timmons and Richard Chang)

(c) Copyright Thomson Reuters 2020.

If one is not familiar with accorded, John Stossel gives a reasonable explanation, of who it favors.

Meanwhile the opposition goes on the rampage drifting to the elections.

U.S. Has Officially Left Paris Climate Agreement | KQED (Fear Pron)

Snip:4-6 minute Read

President Trump originally announced his intention to withdraw from the landmark agreement in 2017 and formally notified the United Nations last year. A mandatory yearlong waiting period ends on Wednesday, a coincidence that nonetheless highlights the Trump administration's commitment to derailing efforts that address climate change.

The U.S. has emitted more cumulative carbon dioxide into the atmosphere than any other country since the industrial era began in the mid-1800s. Current U.S. emissions are falling, but far too slowly to avoid catastrophic warming. That's in part because the Trump administration rolled back carbon pollution limits from power plants, cars, trucks and fossil fuel operations. American emissions rose slightly in the first two years of his administration. In 2020, the pandemic throttled the economy and led to a short-term dip.

"The lack of action at the federal level is a serious problem," says Rachel Cleetus, policy director for the climate and energy program at the Union of Concerned Scientists, a science advocacy group. The costs of climate-driven disasters such as hurricanes, heat waves and wildfires are rising, she says. In 2020, there have already been 16 climate-driven disasters that cost at least $1 billion each, according to the National Oceanic and Atmospheric Administration.

"Climate change is clearly not just an environmental issue," Cleetus says. "It is threatening our economy. It's threatening our future prosperity, the well-being of future generations."

In his inauguration speech, Trump mentioned tax reform. There was a bill put before congress early in 2019 called the H.R. 25 - The Fair Tax Act. It basically makes it a lot harder for the wealthy to avoid paying tax if at alls. If it gets passed it's going to sting a lot of the rich elite!

Brief description:

So basically if the bill becomes an act, people won't be taxed on the money they earn, they'll be taxed on the money they spend and at the time of purchase.

The aims of the Fair Tax Act:

The issues that accompany income tax are listed:

For the purposes of the Act, 'person' includes:

So it's not going to be easy for the rich to avoid paying the tax

Summary of the Bill:

23% sounds pretty hefty, but there are classes of exemptions including for qualified not-for-profits, exporters, and people living at or below the poverty line and rebates for families.

Family Rebate:

Families are also given a $200 administrative credit if they lodge their monthly reporting on time.

Qualified NFP's - the last line will sort the real NFP's from the dodgy ones:

Here's how the revenue will be allocated in 2021:

It had one reading before congress and was sent to the Ways and Means Committee on the same date and not much has been said about it since but it is dated to be implemented 2021. Not sure how things work in the US, but it seems surprising that it only had one reading before being sent to the Ways and Means Committee - on the same day. All proposed amendments to taxation have to go before the Ways and Means Committee, but sheesh, to slide it out that fast without further readings seems hasty.

The Bill was sponsored by Republican Rob Woodall, and had 33 Republican co-sponsors, but the Ways and Means Committee has a Democratic Majority at the moment. I don't know if it's the case that the Ways and Means Committee always has a majority of the opposition party.

The bill also includes a conditional sunset clause in case the income tax act is not repealed.

Apart from individuals and families having to do monthly reporting because, ugh - it's tax, I think it's a good bill overall and certainly gives another angle on the animosity towards Republicans! It closes a lot of the loopholes that are available for the rich to exploit.

It closes a lot of the loopholes that are available for the rich to exploit.

Brief description:

To promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national sales tax to be administered primarily by the States.

So basically if the bill becomes an act, people won't be taxed on the money they earn, they'll be taxed on the money they spend and at the time of purchase.

The aims of the Fair Tax Act:

“(1) To raise revenue needed by the Federal Government in a manner consistent with the other purposes of this subtitle.

“(2) To tax all consumption of goods and services in the United States once, without exception, but only once.

“(3) To prevent double, multiple, or cascading taxation.

“(4) To simplify the tax law and reduce the administration costs of, and the costs of compliance with, the tax law.

“(5) To provide for the administration of the tax law in a manner that respects privacy, due process, individual rights when interacting with the government, the presumption of innocence in criminal proceedings, and the presumption of lawful behavior in civil proceedings.

“(6) To increase the role of State governments in Federal tax administration because of State government expertise in sales tax administration.

“(7) To enhance generally cooperation and coordination among State tax administrators; and to enhance cooperation and coordination among Federal and State tax administrators, consistent with the principle of intergovernmental tax immunity.

The issues that accompany income tax are listed:

SEC. 2. CONGRESSIONAL FINDINGS.

(a) Findings Relating To Federal Income Tax.—Congress finds the Federal income tax—

(1) retards economic growth and has reduced the standard of living of the American public;

(2) impedes the international competitiveness of United States industry;

(3) reduces savings and investment in the United States by taxing income multiple times;

(4) slows the capital formation necessary for real wages to steadily increase;

(5) lowers productivity;

(6) imposes unacceptable and unnecessary administrative and compliance costs on individual and business taxpayers;

(7) is unfair and inequitable;

(8) unnecessarily intrudes upon the privacy and civil rights of United States citizens;

(9) hides the true cost of government by embedding taxes in the costs of everything Americans buy;

(10) is not being complied with at satisfactory levels and therefore raises the tax burden on law abiding citizens; and

(11) impedes upward social mobility.

For the purposes of the Act, 'person' includes:

“(7) PERSON.—The term ‘person’ means any natural person, and unless the context clearly does not allow it, any corporation, partnership, limited liability company, trust, estate, government, agency, administration, organization, association, or other legal entity (foreign or domestic).

So it's not going to be easy for the rich to avoid paying the tax

Summary of the Bill:

This bill imposes a national sales tax on the use or consumption in the United States of taxable property or services in lieu of the current income taxes, payroll taxes, and estate and gift taxes. The rate of the sales tax will be 23% in 2021, with adjustments to the rate in subsequent years. There are exemptions from the tax for used and intangible property; for property or services purchased for business, export, or investment purposes; and for state government functions.

Under the bill, family members who are lawful U.S. residents receive a monthly sales tax rebate (Family Consumption Allowance) based upon criteria related to family size and poverty guidelines.

The states have the responsibility for administering, collecting, and remitting the sales tax to the Treasury.

Tax revenues are to be allocated among (1) the general revenue, (2) the old-age and survivors insurance trust fund, (3) the disability insurance trust fund, (4) the hospital insurance trust fund, and (5) the federal supplementary medical insurance trust fund.

No funding is authorized for the operations of the Internal Revenue Service after FY2023.

Finally, the bill terminates the national sales tax if the Sixteenth Amendment to the Constitution (authorizing an income tax) is not repealed within seven years after the enactment of this bill.

23% sounds pretty hefty, but there are classes of exemptions including for qualified not-for-profits, exporters, and people living at or below the poverty line and rebates for families.

“SEC. 303. MONTHLY POVERTY LEVEL.

“(a) In General.—The monthly poverty level for any particular month shall be one-twelfth of the ‘annual poverty level’. For purposes of this section the ‘annual poverty level’ shall be the sum of—

“(1) the annual level determined by the Department of Health and Human Services poverty guidelines required by sections 652 and 673(2) of the Omnibus Reconciliation Act of 1981 for a particular family size, and

“(2) in case of families that include a married couple, the ‘annual marriage penalty elimination amount’.

Family Rebate:

“SEC. 301. FAMILY CONSUMPTION ALLOWANCE.

“Each qualified family shall be eligible to receive a sales tax rebate each month. The sales tax rebate shall be in an amount equal to the product of—

“(1) the rate of tax imposed by section 101, and

“(2) the monthly poverty level.

Families are also given a $200 administrative credit if they lodge their monthly reporting on time.

Qualified NFP's - the last line will sort the real NFP's from the dodgy ones:

“SEC. 706. NOT-FOR-PROFIT ORGANIZATIONS.

“(a) Not-For-Profit Organizations.—Dues, contributions, and similar payments to qualified not-for-profit organizations shall not be considered gross payments for taxable property or services for purposes of this subtitle.

“(b) Definition.—For purposes of this section, the term ‘qualified not-for-profit organization’ means a not-for-profit organization organized and operated exclusively—

“(1) for religious, charitable, scientific, testing for public safety, literary, or educational purposes,

“(2) as civic leagues or social welfare organizations,

“(3) as labor, agricultural, or horticultural organizations,

“(4) as chambers of commerce, business leagues, or trade associations, or

“(5) as fraternal beneficiary societies, orders, or associations,

no part of the net earnings of which inures to the benefit of any private shareholder or individual.

Here's how the revenue will be allocated in 2021:

“(1) 64.83 percent of total revenue to general revenue,

“(2) 27.43 percent of total revenue to the old-age and survivors insurance and disability insurance trust funds, and

“(3) 7.74 percent of total revenue to the hospital insurance and Federal supplementary medical insurance trust funds.

It had one reading before congress and was sent to the Ways and Means Committee on the same date and not much has been said about it since but it is dated to be implemented 2021. Not sure how things work in the US, but it seems surprising that it only had one reading before being sent to the Ways and Means Committee - on the same day. All proposed amendments to taxation have to go before the Ways and Means Committee, but sheesh, to slide it out that fast without further readings seems hasty.

The Bill was sponsored by Republican Rob Woodall, and had 33 Republican co-sponsors, but the Ways and Means Committee has a Democratic Majority at the moment. I don't know if it's the case that the Ways and Means Committee always has a majority of the opposition party.

The bill also includes a conditional sunset clause in case the income tax act is not repealed.

Apart from individuals and families having to do monthly reporting because, ugh - it's tax, I think it's a good bill overall and certainly gives another angle on the animosity towards Republicans!

It closes a lot of the loopholes that are available for the rich to exploit.

It closes a lot of the loopholes that are available for the rich to exploit.I came across the January 11, 1995 session and arranged in order all the quoted words that the Cs had in that session. This is what came up:

resident., Thump., step by step process., union., draw on our energy., effortless, born, time., up, awake, years., Time, on, see, Lizzie, eat., The fallen Angel., Brotherhood, do, letting go, Millenium, time.

It may be coincidence, but "resident Thump" sounded similar phonetically to President Trump. It seems to imply that he draws on "our energy" (perhaps Cs or STO influence via union on some level? Then there's the blurb about "seeing the Lizzies eat the fallen fallen Angel & Brotherhood" and letting go in the Millenium era.

I've linked a strange press conference here during Trump's time as president:

At the 1:30 mark, a reporter asks him a question about the validity of the theory that "Trump is secretly saving the world from this satanic cult of pedophile and cannibals" and it is soon after the word cannibals is uttered, Trump gestures with a serious face with eyes on the camera and gives a slight nod of acknowledgement. He then goes on to look down and shakes his head as if to signal some type of disgust at this reality.

Given his body language, it makes me think that Trump knows about this secret existence, which ties in with the ordered quotes section above.

Trump was also mentioned by the Cs as not being a "greenhorn", as in a veteran of something, and I wonder if that also ties into this in some way.

resident., Thump., step by step process., union., draw on our energy., effortless, born, time., up, awake, years., Time, on, see, Lizzie, eat., The fallen Angel., Brotherhood, do, letting go, Millenium, time.

It may be coincidence, but "resident Thump" sounded similar phonetically to President Trump. It seems to imply that he draws on "our energy" (perhaps Cs or STO influence via union on some level? Then there's the blurb about "seeing the Lizzies eat the fallen fallen Angel & Brotherhood" and letting go in the Millenium era.

I've linked a strange press conference here during Trump's time as president:

At the 1:30 mark, a reporter asks him a question about the validity of the theory that "Trump is secretly saving the world from this satanic cult of pedophile and cannibals" and it is soon after the word cannibals is uttered, Trump gestures with a serious face with eyes on the camera and gives a slight nod of acknowledgement. He then goes on to look down and shakes his head as if to signal some type of disgust at this reality.

Given his body language, it makes me think that Trump knows about this secret existence, which ties in with the ordered quotes section above.

Trump was also mentioned by the Cs as not being a "greenhorn", as in a veteran of something, and I wonder if that also ties into this in some way.

Trending content

-

-

Thread 'Coronavirus Pandemic: Apocalypse Now! Or exaggerated scare story?'

- wanderingthomas

Replies: 30K -